Hot take:

If you run an online education business, your net margins should be at least 30%.

In today’s newsletter, I’m going to explain why.

Most material on things like margins is written by finance people, and can be hard for entrepreneurs to relate to.

(AKA mind-numbingly boring.)

But my aim today is to convince you why you should care…

And potentially scare the living daylights out of you if your margins are on the lower end.

I’ll cover five areas:

- Natural margins of an online business model

- Resilience

- Ability to scale

- Valuation

- Owner comp

Of course, if you’re a solo creator rocking 95% margins, you’ll probably think this is a load of hogwash.

But speak to a more established business with plenty of overhead, you’ll soon realise that understanding margins is the entire game.

Either way…

Forewarned is forearmed.

1. Natural dynamics of an online business model

First up, let’s talk about where margins naturally fall for an online business.

To state the obvious – different industries and business models have different margins.

For example, if you’re running a restaurant, your gross margin (i.e. food cost) may be 60-80%, but your overheads (staff, premises) will be huge. You’re doing well if your net margins are 5-10%.

For an online business, your gross margins may not be all that different at 75-90% (i.e. staff involved in fulfilment, affiliate costs), but you should have nowhere near the overheads of a brick and mortar business.

What I see across well-run online business is 30% net margins. (Give or take.)

If you’re running an online business and have margins less than this, you have to ask why.

Truth is, a lot of the time it’s just lack of discipline…

You’ve allowed “bloat” into the business over the years and failed to cut back, meaning you’re carrying dead weight.

And when you carry lots of dead weight in the business, there’s a big, fat opportunity cost:

NOT figuring out the leanest and most agile version of your operation.

To spell it out…

You can probably get the exact same results with a lot less cost.

So that’s point 1:

If your margins are below 30%, you’re simply not running an efficient online business.

2. Resilience

Source: sayingimages.com

In the first point, I talked about efficiency.

But you might say “Who cares? We’re making money and I’m having fun!”

Good for you.

They were having a blast on the Titanic too, minutes before it ran into a field of icebergs.

If your margins are low, and your business inefficient, you have very little flexibility when you hit hard times.

The pandemic was a boost for many online businesses… But not all.

A friend of mine in the travel industry saw his revenue drop by 80% overnight in April 2020.

Another friend in the education space had a great boost during Covid, but then saw his traffic drop 30% in a Google algorithm update a few months later.

S*** happens.

And if your margins are only 10-20%, you’ll be stark naked when the tide goes out.

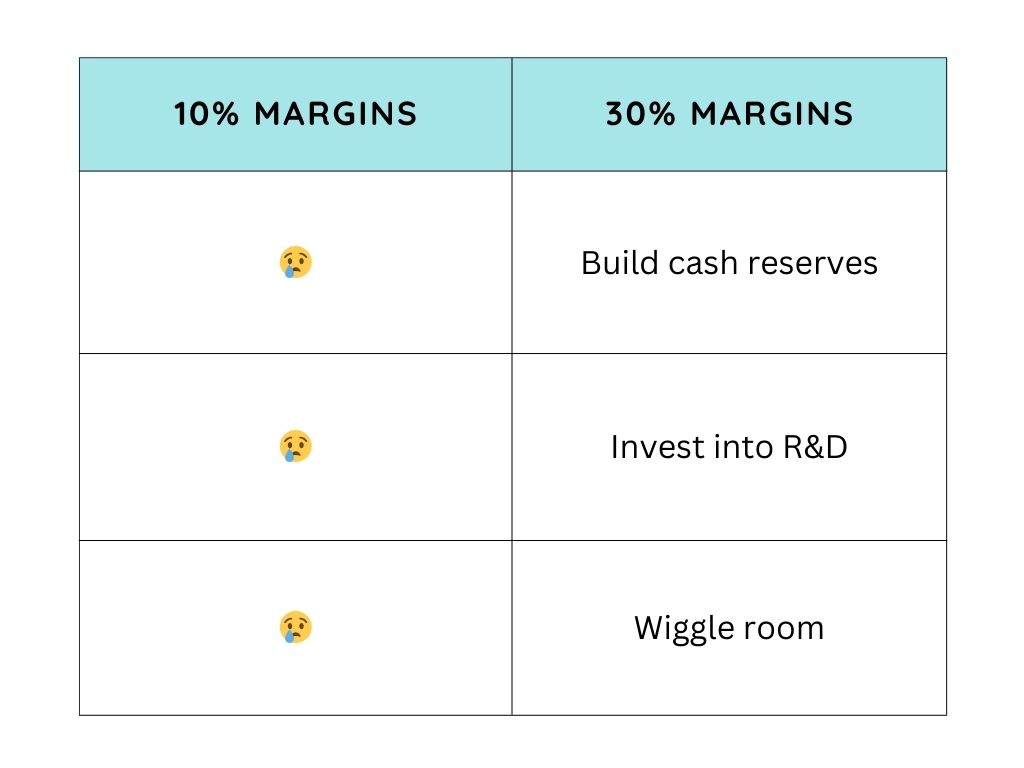

If instead, your margins are 30-40%, you’ve got a lot of resilience built into your underlying business model:

- It’s easier to build significant cash reserves

- You can invest more liberally into R&D

- You’ve got plenty of wiggle room in a crisis

It’s like eating a quality diet vs dining at McDonald’s…

You can survive on both, but only gives you to a spring in your step.

So this is point 2:

With higher margins, your business is stronger in the present and in the future.

3. Ability to Scale

All of my points so far assume that you’re in “Business as usual” mode.

That you’re not aggressively spending on growth, but rather just “Running the biz”.

But at some point, you might want to scale the business.

When you set out to scale a business, a few things happen:

- You spend a lot of cash

- You increase your overheads

- You keep this up for a few years

Scary, right?

Can be.

But as long as you go in with your eyes open, and know what to expect, you’ll be fine.

Unless of course, you begin the process with 10% margins.

Because where on earth is the money going to come from? The amount of available cash is tiny as a proportion of the size of the business.

It comes back to that “efficiency” question.

If you try to scale a business with minimal margins, you either have to:

- bet the house on your plans working

- take on debt

- raise capital

Whereas, if you have 30-40% margins, you can comfortably spend a meaningful amount of cash, even taking margins to zero for a period, and safely ride out the process.

Voila, point 3.

If you want to scale your business, lower margins stack the deck against you from the start.

4. Business Valuation

If you have plans to sell your business, do you know how businesses are actually valued?

Well, I’ll tell you…

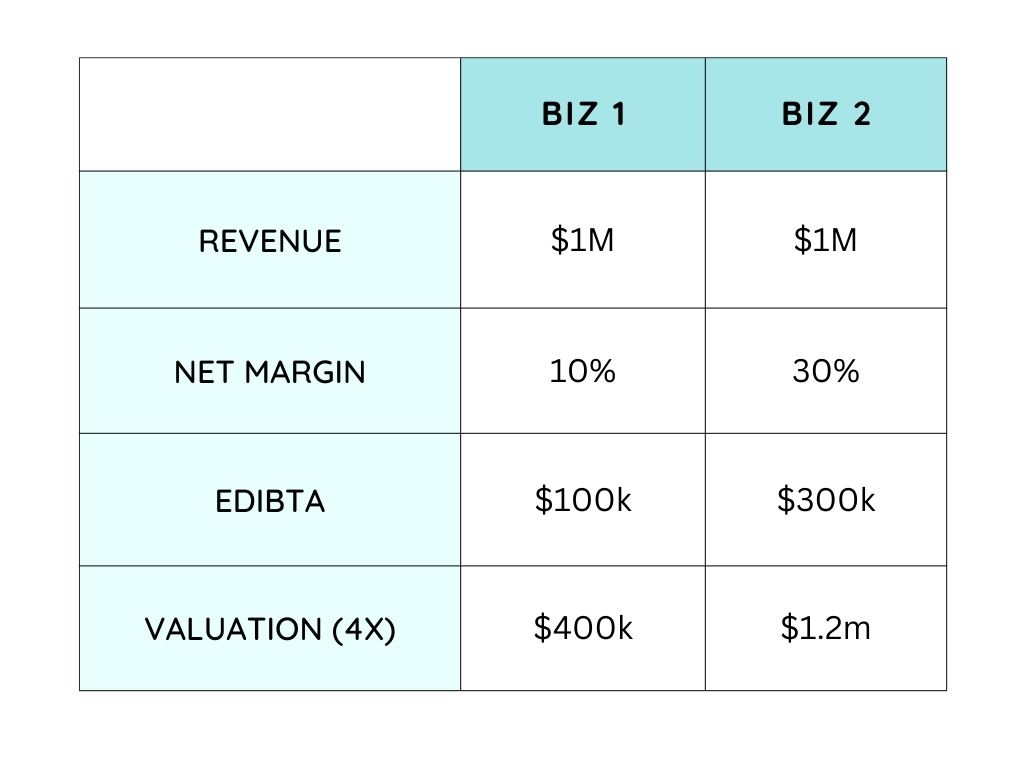

Businesses are valued on a multiple of net margins (or EBITDA if you want to get fancy).

Online education businesses would typically sell for 3-4X EBIDTA.

Let’s look at a side-by-side of two businesses, both doing $1 million in annual revenue, one with 10% margins, the other with 30% margins:

If those numbers shocked you, they should.

Two businesses, making the exact same amount of revenue, one worth 3X the other.

A big lesson I’ve learnt in recent years is that valuation is an excellent lens through which to discover everything that’s wrong with a business.

In most cases, the value of your business is worth nothing more than a simple multiple of the money you get to keep each year.

Not only that…

From a strategic perspective, someone acquiring your business will want to spend money to grow it. And the more free cash flow you have available, the more they have to work with.

And that’s why margins matter:

The higher your margins the more your business is worth.

5. Owner Compensation

While we’re on the topic of selling…

Do you plan to sell your business one day?

Most entrepreneurs have nothing more than a fuzzy notion of “Oh well, I can always sell in the future!”

Statistically, this ain’t gonna happen.

Consider this:

78% of small business owners plan to sell their business to fund their retirement.

But fewer than 1% of businesses ever sell.

Even among those businesses that do list for sale, only 20-40% are successful.

What does this mean?

Candidly, you will probably never sell your business. And if that’s the case, what exactly is your plan to generate wealth?

Again, most people don’t have a plan…

They start a business one day, kinda like it, and just keep on going like a penguin in a dance-off.

So I’ll tell you…

The overwhelming likelihood is that your only option for growing wealth is through owner distributions.

Think of it like a private pension.

If you never take distributions, then all you’ve got is a job.

And if your plan is “I’ll worry about that later”… you don’t have a plan.

So you’ll start taking distributions, right?

Except you’ve only got 10% margins.

Oops.

You see the issue here?

And this is point 5:

Healthy margins allow you to take distributions from your company, and grow long-term wealth.

Conclusion

So what do we have here?

I recommend you maintain a minimum of 30% net margins in your online education businesses.

These margins signify efficiency and vitality in your operation, enabling you to weather storms and scale your business when needed.

Not only that, they increase the overall economics of your business, both in terms of valuation and the possibility of owner distributions.

I decided to write this after meeting business owners who are great with numbers…

But not with the big picture.

Naturally, there’s a bunch of nuance in this topic that I deliberately left out, but hopefully this gives you something to reflect on when you’re planning your future.

Oh, and…

If you don’t know what your net margins are…

Now would be a good time to find out!

Namaste,

Olly