From: Olly Richards12th April 2024Hobbitshire: AKA Atlantis

The other day, I was chatting with an entrepreneur about money.

He was telling me about his strategy for spending the money he makes in his business.

He sent me his priorities:

Probably seems familiar?

For 99.9% of people in the world, this hierarchy makes sense.

But for entrepreneurs, it’s a broken concept.

In fact, prioritising your spending in this way will cripple your growth.

It’d be like swimming the English Channel with a lead weight tied around your leg.

Today’s newsletter is a pep talk on how to rewire your “money brain”, so you can fully step into your role as an entrepreneur, seize the opportunities in front of you, and scale your business to its full potential.

Breaking Your Model Of The World

One of the strangest things about becoming an entrepreneur is the following:

Your model of the world shatters into a million pieces.

Here’s how the world looks to you growing up:

- The education system trains to get into university

- Your university degree determines the jobs you can apply for

- The job market determines your salary

- Your salary determines the house you can afford to live in

- The money left over dictates where you can go on holiday

And on and on it goes.

Everything that’s possible in your life essentially fits into a finite financial pie…

You can accurately predict how much you’ll earn, and therefore how much you’ll have spare for things like savings, mortgage, holidays, etc.

Average salaries in the UK fall somewhere between £30-50k.

The top 2% of earners have a median salary of £100k.

Even the Prime Minister earns “only” £160k.

Point is this:

You grow up with a fixed view of what to expect from life.

Of course, you can ratchet up or down, within certain limits…

- Marry someone with a high-paying job and you can afford a bigger house on a nicer street

- Live frugally (e.g. FIRE Movement) and you can buy your time back or retire early

But you’re fundamentally still playing in the same pool as everyone else:

A zero-sum game of lifestyle trade-offs, where you can choose between material comfort or discretionary free time, but never both.

Because this world is so restrictive, sensible adults make prudent choices:

- pay your bills

- pay your debts

- save as much as possible

- holidays

(Where you’ll notice that the fun stuff always comes last.)

But there’s a good reason for this:

There’s a finite amount of money each month. And when it’s gone, it’s gone!

So you’d better pay those bills first…

And then you’d better save as much as possible…

Because when you throw a family and a mortgage into the mix, the word “risk” starts to take on a whole new meaning.

So that’s it.

The world – as you’re told it is – in a nutshell.

But Then You Start A Business…

But then you start a business…

And your entire model of the world is shattered:

- You didn’t need your degree for this

- There’s no limit to what you can earn

- Your boss doesn’t decide your salary

- You can live on the nicest street in town

- You don’t need to wait 20 years for a promotion

- Your family flies business class with air miles

- You control your own time

All that stuff you thought was true about the world…

The limits on what you could expect in life…

How long it would take to “earn” it…

None of it was true!

This can be quite disorientating.

Because, not only can this transformation happen very quickly with a business, but your friends and family, who are no less smart or deserving than you, are still living in that other world.

This can make you feel like a right old imposter. Guilt-ridden. Not deserving of any of this.

Now, you’d think that, when a new entrepreneur discovers success, like Charlie with the golden ticket, they would double-down…

Grow their business as fast as possible…

Take full advantage of the once-in-a-lifetime opportunity in front of them…

Right?

Yeah, you’d think that.

But, often, the opposite happens.

The old model of the world is harder to shake off than you might think.

Old Habits Die Hard

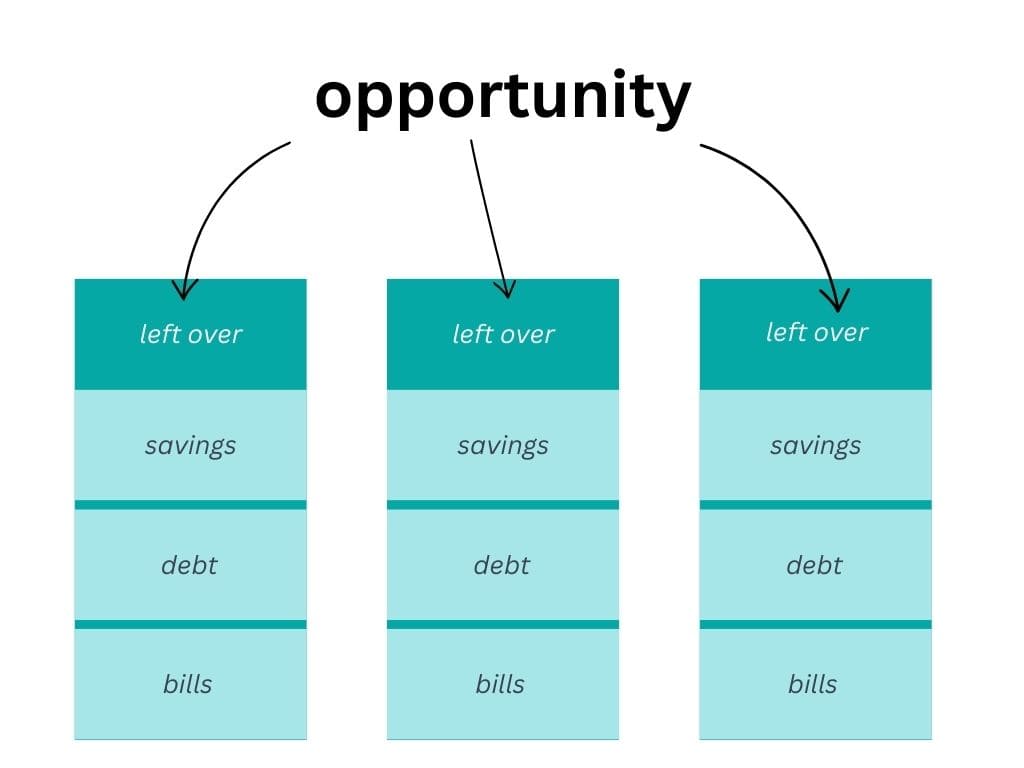

As an employee, your only real financial leverage is to save as much money as possible from your pay cheque each month:

If you inherit a little something from Aunt Doris, you might have the occasional top-up.

But that’s about it.

When you start a business, however, the amounts of money coming in suddenly get a lot larger.

You look at all the cash in your account and think to yourself:

“Well, paint me green and call me a cucumber – I’ve struck it lucky! Better hold on to it all!”

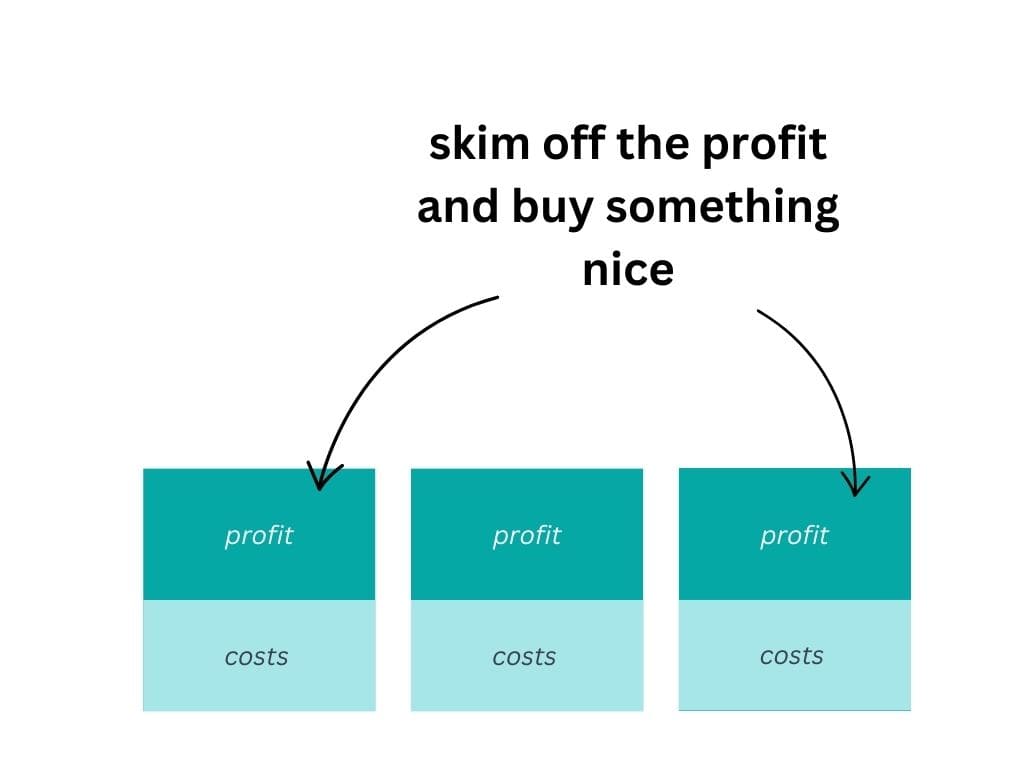

So you treat business profit as your money.

Whether you keep it in the business or take it out as dividends, mentally you have it chalked up as yours:

We can call this Profit Mode – where you keep a hold of profit for yourself.

To be fair, this is a natural response.

Remember the priorities from the old world:

- pay my bills

- pay my debts

- save as much as possible

- holidays

Suddenly, you can put a real dent in your debts, save a handsome nest egg, and have enough left over for a shiny new pair of shoes.

Totally understandable response.

Which is why it’s so important to realise that by taking that money as profit, yours to keep, you’re actually:

Cutting off the blood flow to your business!

That’s right…

By taking your newly-earned cash as profits, you’re actually killing off the business before it’s had a chance to get going.

Here’s the Kraken in the kiddie pool:

It’s not a zero-sum game any more, champ!

That hard ceiling no longer exists.

In fact, all this cash that you’re looking at and feeling proud of yourself for…

There’s a lot more where that came from…

Just so long as you go out and make it!

But in order to make the big bucks, you’ve got to shake off those money beliefs that made sense in your previous life…

But are now damaging you.

Turns out 30 years of money beliefs are harder to shake than you might think.

Like Donald Trump in the White House, they cling on far longer than they’re wanted.

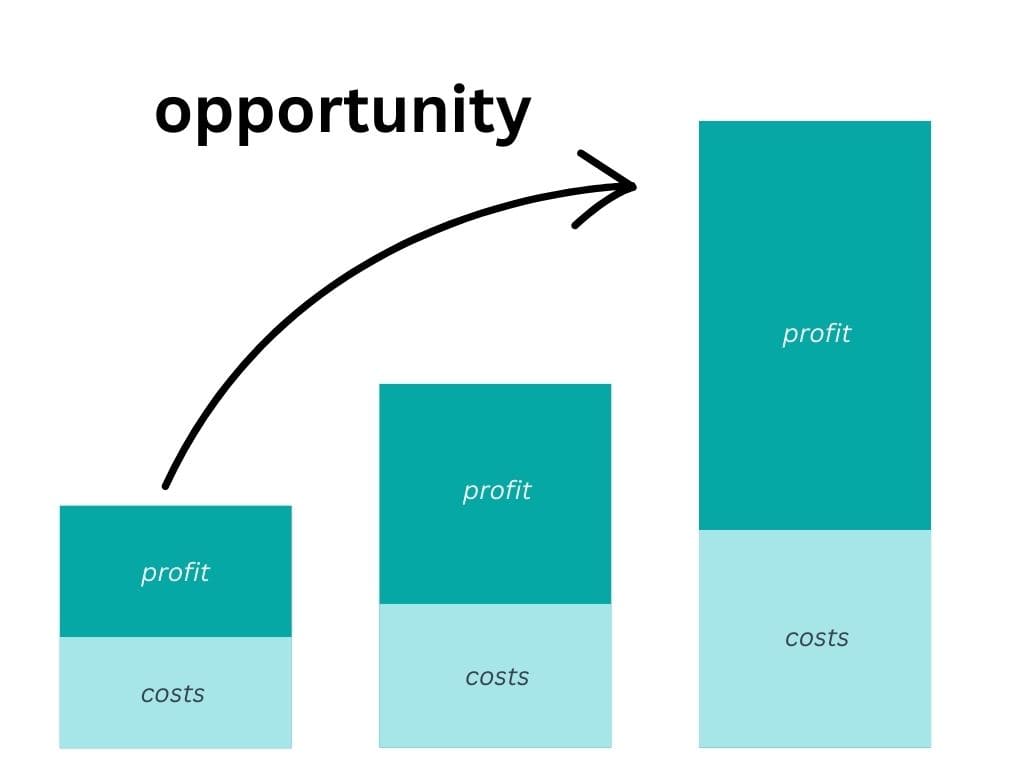

The True Opportunity

As a business owner, the opportunity is NOT to save as much money as possible.

The opportunity is to grow the entire damn pie…

By reinvesting in your business, you can generate a colossal return on your capital…

20%, 30%, 100%, even 200%+ is not uncommon.

For example, in my annual review of this very newsletter, I explained how I would grow revenue from $175k to $1m – a 600% return.

The question is simple…

Would you rather have…

- Quite a lot of money now, or

- A metric s*** tonne of money later?

Money people would quite like the latter.

Instead of Profit Mode, you’ve got to go into Growth Mode, and reinvest your profits into growing the business.

By reinvesting capital, you buy yourself the ability to move faster than you could by yourself:

- More traffic

- Better marketing

- Better sales

With the extra revenue, you can build your team, which buys back your time.

This is where Profit Mode makes sense – once you’ve hit some kind of scale.

But in order to get there, you’ve first got to be willing to stare at a bunch of cash in your account and say:

“No, I’m going to keep my fingers out of the cookie jar!”

Unsurprisingly, this is hard.

Take my business StoryLearning, for example.

We do many millions in revenue, but I work only a few days a month, because I always reinvested back into growth, and took limited profit.

This has enabled us to build a mature team of people who run the business.

As a result, I’m free to roam the hills of Hobbitshire, meet my daughter from school at 3:30pm every day, and generally avoid doing anything I don’t want to do.

It’s a nice life…

And this is possible despite being in a perpetual Growth Mode.

I’ve often thought about slashing costs and entering a Golden Era of Profit Mode…

But turns out I actually enjoy the challenge of growing a company and having a fantastic team around me.

Time over income, that’s what I say.

But whatever…

This is a digression…

My point is that there is major opportunity cost associated with sticking with old money mindsets.

Where Do Returns Come From?

I have to have this money talk with virtually every entrepreneur I mentor who is in the $300-500k revenue range.

They’re typically 2-3 years into their business journey, and sitting on a large pile of cash.

Their first thought is usually to save the cash, pay down the mortgage, all the old money mindset stuff.

But my job is to help them realise that growing their business is the real game in town.

This forces them to re-examine how they look at the world, and it’s one of the biggest mindset shifts they’ll ever make.

For example…

Take a business doing $300k in AR.

Let’s assume you can grow it at 50% year-on-year…

This means it can be doing $450k next year.

In this context, does it still make sense to…

- Pay down your mortgage? (Assuming 3-5% interest)

- Pay off your debts? (Assuming 10% interest)

- Save money in the bank? (Assuming you earn 4% on it)

The answer in each case is an emphatic…

No.

You could convincingly argue that every dollar is better reinvested into your business, where it can make 50% return.

Not least because, in order to realise profit in the business and withdraw it personally, you will:

Immediately lose 50% of it to taxes!

…whereas if you reinvest it back into the business, you keep 100% of it, with none lost to taxes.

In any reasonable scenario, you’ll end up with a far bigger pie later on, which will enable you to pay off the mortgage in one fell swoop, and still have enough left over for a lifetime supply of glittery unicorn socks.

(Oh wait, you don’t have a 9-year-old daughter?)

So…

With all this said…

Here’s how I would re-jig the priority list:

- Reinvest into the business

- Pay my bills

- Save 3 months business cash

- Holidays

- Save 6 months personal cash

- Pay my debts (maybe)

We can quibble about the details.

But you get the point, I’m sure.

Conclusion

In this newsletter, we talked about the paradox of money mindset and how it can impact your growth as an entrepreneur.

Your brain is conditioned to think of the world as a zero-sum financial game. But your model of the world shatters when you become an entrepreneur:

- The limits and expectations you grew up with no longer apply in business

- Treating profit as personal money can cut off your business’s growth

- Reinvesting in your business can generate colossal returns on capital

- Profit mode makes more sense once you’ve hit a certain scale in your business

- There are big opportunity costs to sticking with old money mindsets

So there you go…

That’s your pep talk for today.

If you find this finance stuff interesting, you might like my Financial Zen for Entrepreneurs workshop, where I go deep into the financial frameworks that I use to run my business and life.

Otherwise…

Make yourself a cup o’ tea…

Take seat out in the garden…

And have a long hard think about whether your financial ambitions and your behaviour are truly in alignment with one-another.

Let me know the conclusion you come to.

Namaste,

Olly

CASE STUDY: Blueprint Of A $10m Online Education Business:

- Business model blueprint

- Product ecosystem

- Team structure

- Evergreen sales strategy

- And much more

Join my free newsletter for online educators and I’ll send you the case study immediately…

[tcb-script async=”” data-uid=”10c2395222″ src=”https://skilled-trailblazer-6490.ck.page/10c2395222/index.js”][/tcb-script]

We will protect your data in accordance with our data policy!