Do you know what this blog is?

It’s therapy to myself.

Much of the time, when I choose to write about a given topic, it’s because it’s been on my mind, and I want to organise my thoughts.

It may seem like I have it all worked out.

I don’t.

By the time the topic makes it through my jumbled thoughts onto the pages of this holy blog, I’ve wrestled with the topic enough to feel like I finally get it.

By writing about it here, I’m saying to myself:

Listen up, you moron! Let’s see if you learn this lesson for once and for all!

And today’s topic is about something pretty fundamental…

Making strategic decisions.

Because who doesn’t want better strategy?

Making Strategic Decisions

If entrepreneurship is anything, is it not making decisions?

The decision to start.

The decision to hire.

The decision to innovate.

Entrepreneurs make decisions. In fact, decision-making is so important that any decision is better than no decision.

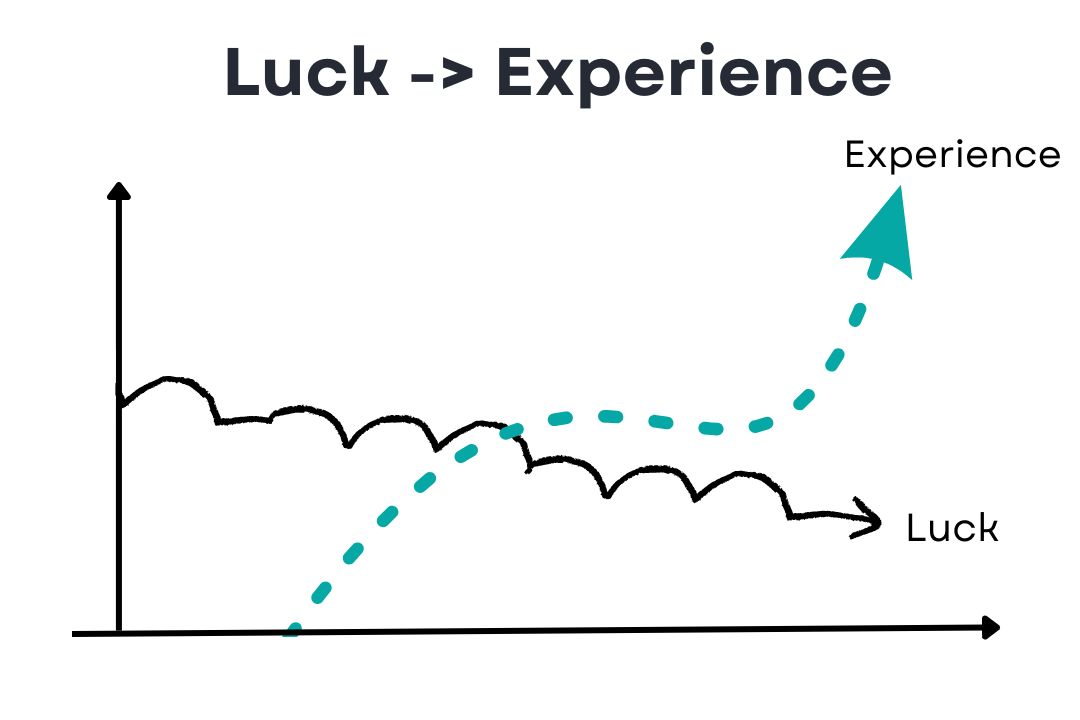

When you first start out, a lot of your good decisions will actually be a byproduct of luck. (Yeah, I know you don’t want to believe it… But it’s true.)

However, I feel that:

The role of luck reduces over time, as experience takes over.

Experience must take over.

When first started, it didn’t matter if you got things wrong – there was nothing to lose. (That’s partly why it felt more fun back then.)

But when you have revenue to maintain, salaries to pay and a lifestyle to protect, well there’s a hell of a lot to lose.

So, decisions can no longer be stabs in the dark, and must instead turn into informed bets based on experience and perspicacity.

As your decisions get more strategic and there’s more at stake, they can feel harder and more confusing:

- Should I hire an A-player or up-skill the team?

- Should I diversify my traffic sources or stay focused?

- Should I invest in growth or improve current operations?

I’ve found that obsessing over the “right decision” is the wrong way to think about it.

Because the right answer depends on who’s making the decision.

That’s right…

This newsletter isn’t about making the right decisions.

It’s about understanding who gets to make the decision

The 3 Hats Of The Entrepreneur

You see, when I’ve agonized over a decision, it’s usually been because I haven’t been clear who is making the decision.

Let me explain…

There are three characters at play in your business:

- The operator

- The business owner

- The investor

(You could add a fourth role: the “creative”. But I’ll leave that out for simplicity.)

As the entrepreneur, you need to wear all these different hats at different times… whether you realise it or not.

Each of these characters has different priorities:

- The operator is concerned with smooth, day-to-day running of the business

- The business owner is concerned with the long-term health of the business

- The investor is concerned with getting a return on their money

Given their different priorities, each character may come up with wildly different solutions to any given problem.

This is why you can find big decisions so hard – it’s not a simple question of logic.

It’s whose logic.

For example, if the operator sees messiness around her, she’s gonna want to spend time fixing it before growing the business further.

But the investor won’t care about a bit of operational chaos if he sees the opportunity to grow revenue next quarter. “A little messiness never killed anyone!”

As founder, do you see how this can lead to a dilemma if you’re not clear on the competing voices?

What I’ve learned about hard decisions is that all three characters can be shouting different things at the same time. In order to make the right call you have to understand what each character wants… and what’s behind it.

Once the rationale is explicit, you can decide whose opinion deserves to hold more sway in that specific situation. With all of this clear, you’re in a better position to make an informed decision.

..

Quick time out…

This is the bit where I remind you that my newsletter is self-therapy.

The way I just laid things out sounds so simple.

But I regularly catch myself agonizing over a decision… only later realizing that I never took the time to work it through from different perspectives.

It’s often just a case of carving out an hour to sit down quietly with a pen and paper… and think.

Funny how it’s easy to know what you should do… and still not actually do it.

..

Anyway, back to it…

What I’ve just shown you is the different interests at play within your business (even more so as you grow), why they can have competing priorities, and how this can make decision-making tough.

In the rest of the newsletter, I’m going to go into more depth about why these roles have different agendas, and then play out a few big decisions through the lens of these characters.

Who Wants What In Your Business?

So, what’s the deal with these characters, then?

What kind of things are they thinking about?

The Operator

The operator’s role is to run the day-to-day in the business, and keep things going smoothly while executing the business plan.

If your business is under $1m in revenue, this will be where you still spend most of your time.

The kind of questions the operator asks when considering a decision:

- Will this make things run more or less smoothly?

- How will the team react to this?

- Do we have the tech stack necessary to pull this off?

The Business Owner

The business owner is concerned with strategy and the overall health of the business.

Through a financial lens, this might mean questions around profitability and cashflow. But then there’s the personal side, which you ignore at your peril – “Is this business giving me what I want from it?”

While the operator is concerned with keeping things simple, the business owner might be looking ahead 2-3 years and have other priorities.

Questions that a business owner might ask:

- Where will this sit on the P&L?

- What will this do to margins?

- Does this get us closer to our three-year goal?

The Investor

The investor is looking to get a return on their money.

You might not think of yourself as an investor in your business, especially if you’re bootstrapped. But this still applies to you, as you will have equity inside your company.

Remember – any amateur investor can stick money into the public markets and get a 5-6% return without lifting a finger.

Given this, why would anyone choose to invest in a (much riskier) private business instead? To get higher returns, that’s why.

But because private businesses are riskier than the markets, an investor would want a better return – starting at 10-20% and upwards. If they can’t get that, better just to leave the money in an index tracker and hit the beach.

Is your business growing 10-20% a year?

If not, you gotta consider that fact that you could get more out of your money elsewhere… entirely passively, without having to run a business. (A sobering thought.)

Questions the investor might run past any decision :

- Does this help us keep pace with the industry?

- Will this get us closer to our EBITDA goals?

- Is this a big enough play given our cash position?

So there we go.

Can you recognize all three characters in you?

If not, can you see why perhaps you should?

Decision Role-Play

Let’s take a typical strategic business decision and examine it through the lens of all three characters, to see how this might play out in the real world.

Scenario:

Your online training business has recently hit 7-figures in annual sales, with good profitability. You’ve been grinding away for 7 years. You’re both proud and exhausted at the same time.

Dilemma

Do you…

a) Slow down, take some profits, and stabilize the businessb) Double down, reinvest profits and try to scale the business to $5M?

This is a very common scenario that entrepreneurs face at the $1-2m stage, including a number that I have mentored or invested in in recent years.

Wearing different hats, how might you respond to this dilemma?

..

Take a moment to think it through, before you carry on.

..

Here’s what’s likely to be going on in the head of each…

- Operator – We’ve been holding on by the skin of our teeth for far too long. It’s time to reinvest into team and systems, so that we can deliver the product without being so stressed all the time.

- Business Owner – I’ve been working my arse off for 7 years but have nothing to show for it financially. All I want to do is take a break, and some profits, so that I can feel a bit more stable at home.

- The Investor — Finally, some traction! Now we know what works, it’s time to reinvest everything we have in scaling marketing and sales. In fact, we should consider raising some investment to speed things up. We could scale this thing to 8-figures within 3 years if we knuckle down.

Can you feel how raw these competing visions are?

This is how it’s possible to feel both exhausted and excited, rich and poor, stressed and energized… all at the same time!

So, what’s the right decision here?

Well of course, there isn’t one. (Welcome to entrepreneurship!)

But there is such a thing as a wrong decision, one made without factoring in all the different parts to the equation.

I’ve found that the only pathway through these decisions is as follows:

a) Acknowledge the competing visions at playb) Understand what each one wants and get the options on the tablec) Make your decision with a clear view

Entrepreneurs tend to swing to the extremes:

It wouldn’t surprise me at all if the business owner in the above scenario either retreated into their shell, and stopped selling, just to feel in control again…

Or on the flip side…

Went on a hiring spree, reduced profits to wafer-thin levels, and suffered a massive burnout 6 months later.

(i.e. swinging to the extremes.)

What I tend to advise people in this situation is to carefully think through all the competing needs you’re carrying – consciously or not.

In this particular situation – coming off the back of significant growth, the best move is often to slow down and regroup.

“Hurry up and slow down”, as a mentor often told me.

And the reason this is important is that it’s really easy to let your alpha side call the shots – “Gotta 10X, bro!” – and to think of slowing down as a sign of weakness.

Whereas, in reality…

Playing the long game, tempering your ego, and building resilience usually serves you best in the long-run.

One thing’s for sure in this scenario:

You can’t scale anything if operations are broken, so you need to properly resource the business.

But also…

You can’t function as an effective business owner if you don’t feel rewarded, so you should consider taking some profits.

For that reason, scaling is probably priority #3 on the list. Because if you try and scale something that’s out of alignment, you’re only setting yourself up for a world of pain.

If anything, it’s a sequencing problem.

Nothing more.

But if you put that same question to an alpha mastermind group, you’ll only ever get one answer: “10X, bro!”

When you look at everything in the round, doesn’t it feel like an easier decision?

A 3-Step Process To Making Hard Decisions

So let’s get down to brass tacks.

How should you chart your way through the choppy seas of strategic decision making?

Well, I’ll tell you how I’m trying to do it.

I say “trying”, because like I keep saying, doing this takes discipline.

I’m hoping that by writing this stuff to you, I’m raising the bar for myself… And hopefully I’ll be more likely to take my own advice when it comes to these big decisions.

But anyway…

When I’m on form, here’s the 3-step process I follow.

(C’mon, this wouldn’t be a business newsletter unless there was a “3-step process”, would it?)

- Awareness – Start by putting yourself in the shoes of each character and acknowledging their interests. Operator: “How do I make things run smoothly?” Business Owner – “How do I secure the future?” Investor “How do I get a return on my capital?”

- Role-Play – Run your decision through each character’s lens. Who wants what? Make a list. This takes the emotion out of the equation and makes things explicit.

- Decision – With everyone’s agenda out in the open, and everything given its due, it’s time to make a decision. Whose opinion counts most right now? Whose opinion has historically been ignored? Is there a compromise to be made?

In this process, there’s no escaping the decision itself.

The responsibility is still on your shoulders.

But at least this helps you get a 360° view of the decision.

If you’re anything like me, you tend to usually only look at decision through one lens. (For me, it’s the business owner lens. I easily ignore the operator and investor.)

This process makes sure you consider the issue from all angles-operational and financial, short-term and long-term – improving the likelihood that you will make a wise and informed decision.

Conclusion

Alright, let’s wrap it up!

When it comes to making better strategic decisions, you gotta understand the different hats you wear in your business:

- The operator

- The business owner

- The investor

Each one has their own agenda and priorities, and these can cause confusion and conflict in decision-making if you’re not conscious of each.

By taking the time to recognize and consider their perspectives, you can make smarter choices.

To do this:

- Be aware of what each character wants

- Role-play the decision from the point of view of each

- Finally, make your decision with a clear understanding of everyone’s interests

It’s like getting a 360° view of the situation.

Decision-making is an ongoing learning process, so thinking in this way is a habit… not a one-off exercise.

So, whaddya think?

If you’re facing a strategic dilemma right now, let me know – go ahead and send me an email with the decision through the lens of each role, and I’ll send you my thoughts.

And if you have an entrepreneur friend who’s got things on their mind right now, do me (and them) a favour and send them this post.

Lastly – hit me up on Twitter if you have any questions.

I’ve been having a whole lotta fun over there lately.

Namaste,

Olly

CASE STUDY: Blueprint Of A $10m Online Education Business:

- Business model blueprint

- Product ecosystem

- Team structure

- Evergreen sales strategy

- And much more

Join my free newsletter for online educators and I’ll send you the case study immediately…

[tcb-script async=”” data-uid=”10c2395222″ src=”https://skilled-trailblazer-6490.ck.page/10c2395222/index.js”][/tcb-script]

We will protect your data in accordance with our data policy!