The other day, I received a message on Telegram:

“I’ve built up $300k in cash. I don’t know what to do with it.”

I sent my reply in a voice note.

The guy liked what I had to say:

This means that, more often than not, all that hard-earned money ends up getting p***** up the wall.

In the case of this particular guy, he hired me to mentor him on scaling his business… but I suspect the true value for him will actually be what he ends up doing with all the extra money he makes.

Today, I’m going to tell you some of what I said in this voice note.

(I can’t reveal all of it, unfortunately!)

It’s this:

How I think through the question of deploying money across your life and business.

You guys seem to like when I write about money topics.

So here I am, shamelessly feeding the lions…

Enjoy!

The Problem With Cash

We have to start with this.

Because a lot of people are just going to ask What on Earth is wrong with having loads of cash?

In fact, a good friend of mine said to me the other day…

“Olly, I’ll never feel successful until I have £1,000,000 in cash!”

To which I promptly replied…

“If you have £1,000,000 in cash, you’ve really f—– up!”

So here goes…

We can all agree that cash is necessary.

In fact, cash is king.

When you don’t have cash, there’s only one thing that will save you…

Cash.

But to say that Cash is King is not to say that having boat loads of cash just building up in your bank account is the right answer.

You need enough cash.

But no more than that.

Three reasons:

- Inflation – If you have $100k in the bank, it loses $10k to inflation in just 12 months.

- Lack of discipline – Large cash balances tend to lead to undisciplined spending and lack of attention to key financial metrics.

- Raises the stakes – As your cash balance grows, so does the pressure to spend it “the right way”, which can lead to anxiety and paralysis.

So, as I said, you need enough cash.

But what does enough mean?

This depends entirely on your strategy and your beliefs.

At one extreme, if you’re in the M&A business and optimise for opportunism, you may intentionally build up 8-9 figure cash balances.

Me?

I’m as far away from that business as a vegan in a steakhouse.

So hows about I just tell you how I think about money, and how I decide what “enough” is?

See, the point here isn’t to think about money in exactly the same way I do.

The point here is…

Well, the point is to just think… period!

Start thinking through money questions, and you might just find a core belief of your own, sipping on a piña colada.

Guiding Money Beliefs

In the next section, I’ll give you a “decision tree” for this question of how to spend $300k.

But before I give you that, I need to tell you my core beliefs that make these decisions possible.

In all questions of money, what’s crucial is to discover your own beliefs.

Only then can you make decisions, in accordance with those beliefs – rather than get sucked into ego-driven Twitter narrative of what wealth is.

(Like having £1,000,000 in cash.)

So here goes…

- Money needs to flow – Money is not real, it’s a proxy for exchange of goods and services. Consequently, when money sits still without a purpose, it starts to fester.

- Your business is your primary wealth driver – You can get a better return on capital within your business than in any other vehicle. (100% is not unrealistic, versus 7-8% in the money markets)

- Safety nets give peace of mind – There’s nothing worse than making bad decisions from a place of desperation. Cash buffers provide this security.

- You have to take chips off the table – Statistically, your business will never sell. This means your go-to option for building wealth is owner distributions. Therefore, you need to take chips off the table as you build.

- Don’t make decisions out of fear – We’re conditioned by society to think of money as a finite resource, and thoughts of losing money can be terrifying. This can lead to fear-based decisions, which are usually bad.

- Never spend just to minimise taxes – Paying 30% tax might hurt, but spending 100% of gross just to avoid paying the 30%… is just plain dumb. Pay your taxes and put what’s left to work.

Got all that?

You may agree or disagree, doesn’t really matter.

But I want you to know that these are the beliefs I’m operating with…and roughly in that order of priority, too.

So now…

“How should I spend that $300k?”

Calm those jitters, my friend!

The cat will now exit the bag…

What Should I Do With $300k?

Here are the seven questions I’d ask myself, to decide how to spend $300k.

Ask the questions in this order:

Question 1 – Do I have 6 months of personal and business cash saved?

This is Step 1 in creating a stable financial base to operate from. For both business and personal, you want to make sure you have at least 6 months of expenses in cash.

You can quibble over the exact amounts, but the point is to get yourself in a position where, if the s*** really hits the fan, you can survive for a good length of time without having to sell your house.

So, if you find yourself with a spare $300k, forget the Porsche. Fund these accounts instead.

Start with the business (because this is upstream from your personal income), and move to the personal next. What you are really buying here is the ability to sleep at night.

Question 2 – Have I set aside contingencies for all tax owed?

Now that we’ve dealt with your “survival funds”, we move on to liabilities.

When you owe tax on profits, it’s not your money.

If you allow that cash to sit in your bank account, you’re pretending you have more cash than you actually do.

It’s not your money – it’s just passing through on its way to the tax man.

So, if you have surplus cash, and haven’t set aside enough money for tax, do that next.

Question 3 – Am I fully-funding all growth opportunities in the business?

Now you’ve taken care of emergencies and liabilities, now you get to choose what to do with your cash.

Belief #1 above was: Your business is your primary wealth driver.

Therefore, if you can grow your business, you must make sure you’re giving it the funds it needs.

R&D, new hires, infrastructure – whatever it takes. Do this next.

Question 4 – Am I investing properly in my own learning and education?

Give $300k to 10 different entrepreneurs, you’ll get 10 very different results.

What accounts for the difference? (Apart from blind luck.)

Skill and knowledge.

Any seasoned entrepreneur will tell you that their own education has always provided their biggest ROI.

So, a hefty chunk of your $300k should go into learning.

(I pay my mentor $12k per month. And it’s worth every penny.)

Question 5 – Do I have any significant financial commitments coming down the track?

There’s wasteful “lifestyle creep”, and then there’s reality.

If you need a bigger house because your kids are climbing up the walls… then you need a bigger house.

But that deposit isn’t going to save itself, so you may as well put the money aside while you’ve got it.

Your business is here to serve your life, not the other way round. Skimp on the things you don’t care about, not on the things you do.

Question 6 – Am I maxing-out all personal annual tax allowances?

Every year, you’ve got tax allowances that allow you to withdraw money from the business in a tax-efficient way.

In the UK, those are:

- Pension

- ISA

In the US, there’s a IRS Roth K401 thingamajig.

Whatever.

Remembering that (#4) you have to take chips off the table, these annual allowances are, hands-down, the easiest way to build long-term wealth.

If you can, max them out every single year.

If you can’t, put as much as you can.

However, rather than putting in a lump sum from your freshly-minted $300k, it’s better to automate your contributions.

After 10 years of small monthly contributions (that you don’t even notice), you’ll see 7-figures in your savings accounts and thank your lucky stars that you read this newsletter on a damp Friday afternoon in October.

You’re welcome.

Question 7 – Do I have a rigorous, tax-efficient plan for investing?

So, you’ve done all of the above?

- You’ve built your emergency funds

- You’ve covered your tax

- You’re feeding your business

- You’ve maxed out your tax allowances

Next up, you need a robust, tax-efficient plan for deploying surplus cash.

At this level, it’s very, very easy to frit away surplus cash in an orgy of impulsive spending.

This should scare you!

I’ve seen so many high-income or post-exit entrepreneurs lose millions on rash decisions…

- investing in your mate’s startup

- that stupid car you don’t need

- investment property

But really, this is your prime opportunity to take chips off the table and build an off-ramp from your business.

Fix the roof while the sun’s shining.

For this to work, you need discipline… and a plan.

Wrong decisions here can cost you 30-50% in unnecessary taxes, which, in turn, sets your plan back years.

For me personally, my goal isn’t to get rich. Really, it’s not. My goal is to create the freedom to enjoy life the way I see fit.

And money is the means to doing that.

I could write an entire newsletter on this point alone, so I won’t even try here. (Hit me up if you want more thoughts on this.)

Point is, with whatever’s left over with your $300k, have a plan and stick to it.

…and there we have it!

Conclusion

The great Dan S. Kennedy once wrote:

“The purpose of a business is to make its owner rich.”

And in this newsletter, I’ve walked you through my thought process for spending cash in a business, in order to achieve that lofty aim.

I can sum it up in the following way:

- Your business makes you rich

- Investing the proceeds makes you wealthy

- Having a plan is how you create freedom

You don’t have to have the same beliefs as me.

But what I recommend is to have beliefs – whatever they may be.

Learning to articulate your beliefs around work, money and life is – I believe – how you find freedom, because then you’re beholden to your authentic self, rather than some image you’re being sold on Instagram.

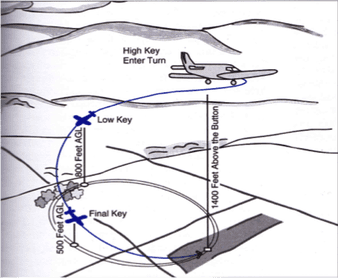

And with that said, I’m off to the airfield.

Today, we’re doing “PFLs.”

No…

Not Product Launch Formulas!

Practice Forced Landings.

(Image source)

They’re nowhere near as scary as they sound.

In fact, there’s a kind of calm serenity that washes over you when you’re plummeting to Earth at 500ft/minute, but still have plenty of time to find a field and put yourself down in one piece.

There’s a parallel with financial planning, there.

I’m sure of it.

If you can spot it, you’re doing well.

Namaste,

Olly