From: Olly Richards

15th March 2024

Hobbitshire: Not an invoice in sight

Finance is never a problem for an online business…

Until it is.

For the first 4-5 years of my business, I managed everything from my one bank account.

Quite happily.

We got cash?

We good!

But as we grew, things started getting more complex.

Before I knew it, I lost track of what was happening…

Cash flying in and out of the bank account every which way from Sunday, in ever-increasing numbers, until I had no idea where the money was coming from, where it was going, and no way to easily find out.

Worse…

I was spending half my week dealing with invoices and bookkeeping queries because I didn’t have, or trust, anyone else to handle the finances.

The result?

At best, loss of productivity.

At worst, stress and anxiety.

And what’s for sure:

Failing to get to grips with basic financial systems was seriously holding back the growth of the business.

I figured it all out eventually.

To the point where, today, I can easily manage ALL the finances of a multi-million dollar business…

In about 15 minutes a month.

This newsletter is a practical guide on how to do it.

The Overall Picture

One thing before we start:

Depending on the size of your business, you probably won’t need to do all the stuff I’m about to show you.

This is very much geared towards a more complex, high-volume business.

Bear this in mind, and try to parse the ideas here according to where you specifically feel bottlenecks.

Now, my intention is for this to be super practical.

So let’s get to it.

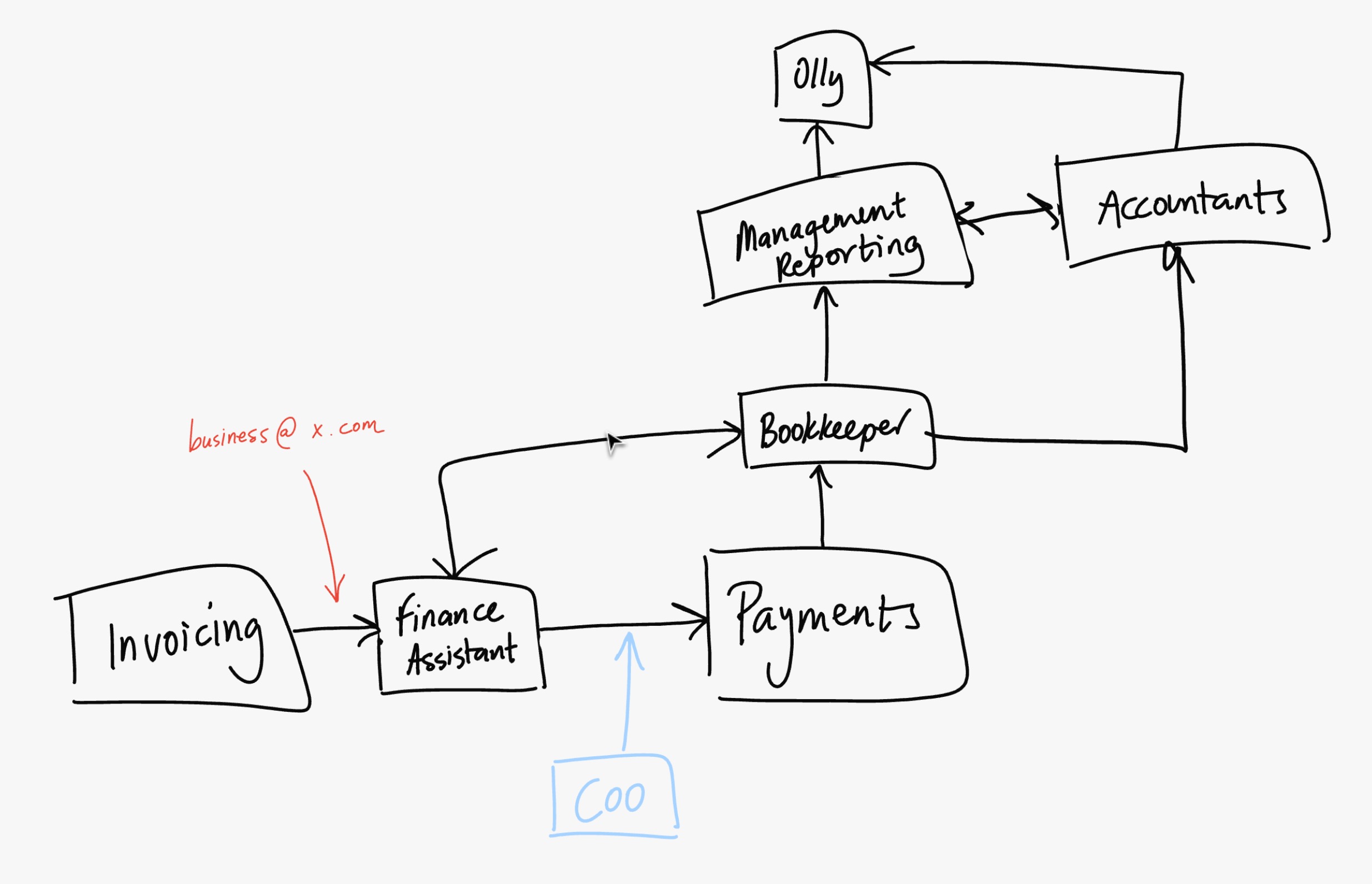

Here’s an overall view of our finance workflow within the business:

I break this down into three main functions:

- Front-End: Invoices & payments

- Middle: Bookkeeping

- Back-End: Reporting & accounting

Invoicing and payments are daily, ongoing, and is where your business interacts with vendors (contractors, SAAS, etc.

It needs constant attention and oversight.

Bookkeeping tells you what has happened – it’s backward-facing.

It’s a fortnightly or monthly process of simply documenting what’s been earned/spent, and matching payments from your credit card or bank account to the corresponding paperwork.

Accounting tells you what has happened, but deals with the legal consequences – filing, taxes, dividends etc.

Reporting is mostly forward-facing.

Also known as Management Accounting, it takes all the information from your bookkeepers, and uses what’s happened to predict what will happen in the future, using your budget or forecasts as a guide.

That’s why it’s forward-facing in nature.

Front-End: Invoices & payments

Lemme tell you why I needed these functions.

First, invoices and payments.

A few years back, I was spending hours each week on finance admin.

Contractors would email invoices, and I would pay them out myself. Often, I would pay late because I hate my inbox.

Whenever my bookkeepers had a query, they would land in my inbox.

Every month, I’d have to answer dozens of queries like:

“The invoice for the payment of £26.45 on 5/7 is missing. Please provide it and let me know what it was for.”

At which point I would have to trawl back through my email and dig it out… which could take 5 minutes just by itself.

For years, I held it together.

Eventually, it got to stupid levels.

Not only did I hate this admin, it was taking me dozens of hours each month.

I remedied it by hiring a Finance Assistant to own this entire function:

- processing invoices

- making payments

- responding to bookkeeper queries

Two things were key to making this happen:

First, we created a new and separate email address (business@~.com) to manage all financial aspects of the business:

- SAAS logins

- Freelancer invoices

- Internal correspondence

This was vital, as stuff no longer had to pass through me – I didn’t even need to see it, which in turn frees up a bunch of headspace.

Second, we set up roles in our banking.

Everyone’s big objection to hiring for this is trust – trusting someone else to manage business finances.

If you have good banking, you can set up roles for different people, which gives certain permissions, notably:

- preparing payments

- approving payments

So, Finance Assistant can prepare the payment of an invoice, then you can approve it, which is super quick.

(You can even have someone on your leadership team approve payments, if the trust is there, freeing up even more time.)

Setting this up was transformational, because I regained 5+ hours a week, and no longer had to think about it.

Middle: Bookkeeping

Right from the beginning of StoryLearning in 2013, I had a bookkeeper.

I had a bookkeeper because I had no idea how to do the books myself.

I didn’t even know what “books” were.

In fact, I can’t imagine life without a bookkeeper.

So you can imagine my incredulity when I meet 6-figure business owners who still do their own bookkeeping.

Happens all the time.

Sometimes, people aren’t even aware what a bookkeeper role is.

So let me spell it out:

Bookkeepers document what’s been earned and spent in your business, by matching payments to/from your bank account to the corresponding paperwork (invoices/receipts).

Usually, this is done in software like Xero or Quickbooks.

This is needed so that you can file accurate accounts.

I’ll just say this straight:

There is no circumstance on God’s green earth in which it makes sense to do your bookkeeping yourself.

Yes, even if your business is simple.

Here’s why:

- There is literally zero value-add to using your time in that way. It does nothing to grow the business.

- As your business grows, it’s going to take more and more of your time, and will eventually become a drag. Better to get used to it now.

Yes, I know it’s an expense.

But, just like with the Finance Assistant role from earlier, these kind of finance roles are standard fare in the business world, and easy to fill with relatively low-cost professionals who will do a great job – far better than you ever could.

Just trust me on this one.

(If you want recommendations for where to find low-cost finance assistants - just hit me up.)

Back-End: Reporting & Accounting

Now we get to the fun stuff 🙂

At least, it’s fun once you’ve got it all sorted.

Truth be told, it’s a nightmare before that.

Anyway…

Reporting and accounting are NOT the same thing.

You probably have accountants.

And you probably don’t like talking to them very much.

That’s ok – they understand why 🙂

There ain’t no getting around your filing obligations as a company. And it’s never fun to do it. So let’s not waste any time bemoaning all that, eh?

Now…

The fact that everyone has accountants means that most people trust their accountants to provide them with information.

Useful information.

Information you can run the business with.

And this is where the problems start.

See, when I first got started, I was operating with “knowledge deficit” – just like everyone else.

I didn’t know what I didn’t know.

And for years, I just accepted the information that was served to me, like Oliver being served hot gruel at the orphanage:

Please, Sir! Thank you, Sir!

But the thing is…

The information wasn’t very useful.

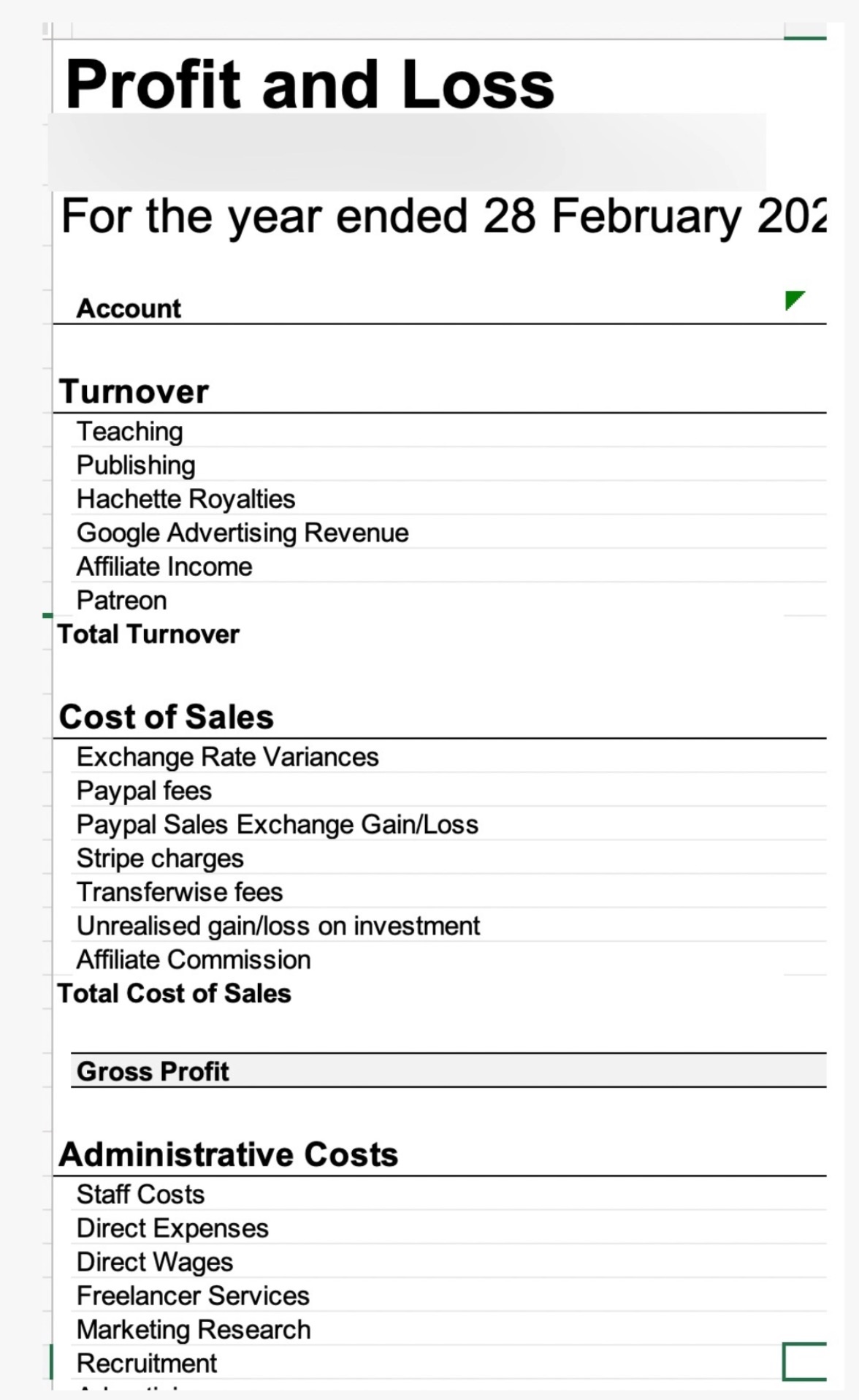

Here’s what my P&L used to look like:

Look at those items in the boxes.

If you’re anything like me, seeing stuff like this is enough to make you break out in hives.

There was too much detail. Everything seemed “muddled up”. I couldn’t do anything useful with the information.

I was told:

“We need to do things this way for filing purposes.”

And I just nodded along like a drowsy owl.

Who was I to argue with my accountants?

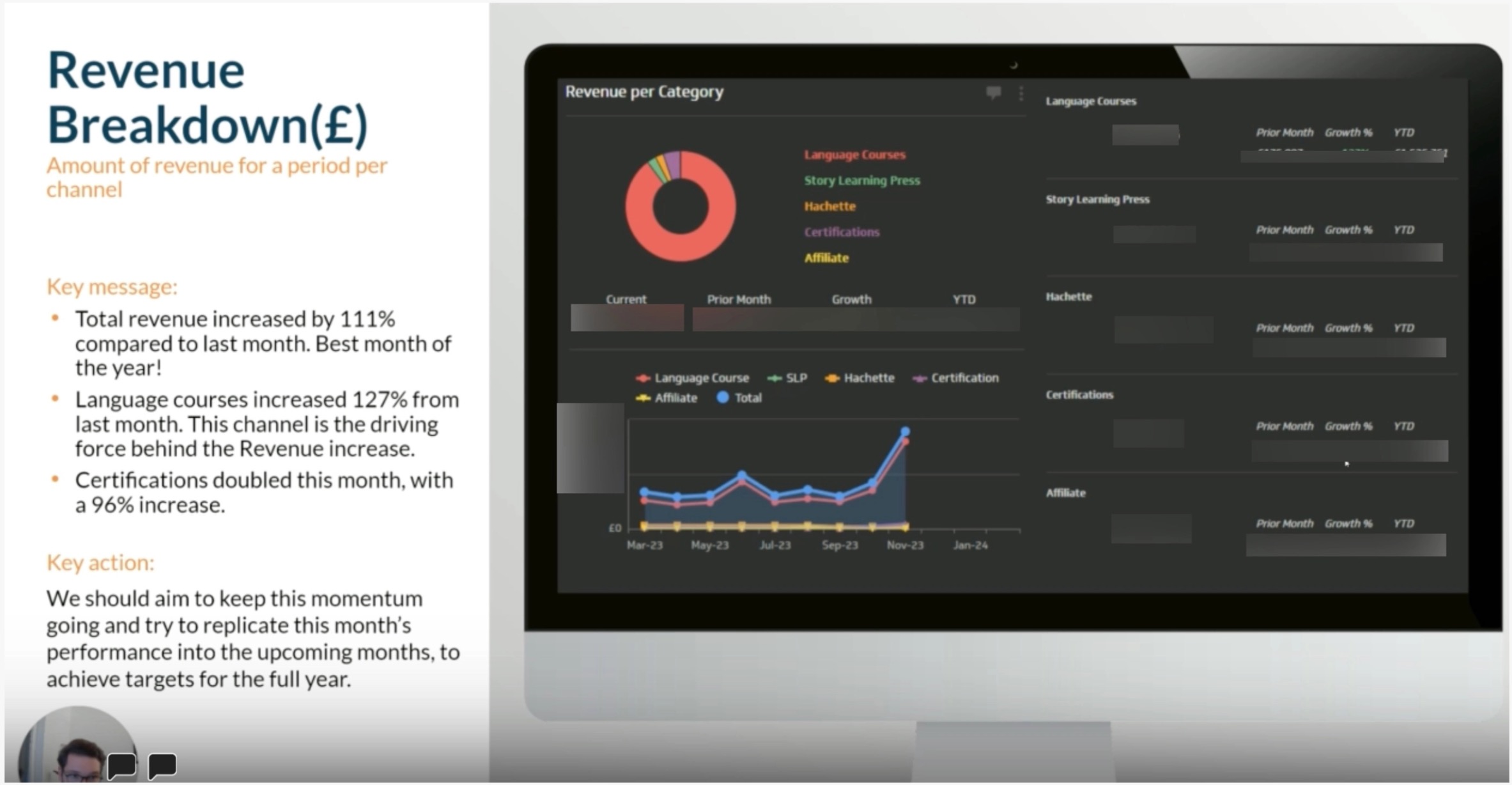

Here’s what my reports look like today:

Tailor-made for what I need:

- All key numbers on one slide

- Reporting that aligns with strategy

- Important trends highlights

They show trends in KPIs like:

- Revenue

- Gross margin

- Overhead

- Refund rates

- CAC

Totally changed the way I manage my business.

For example, these reports might identify a gradual rise in refund rates. Knowing this, the team might revise down our predicted gross margin for the year.

Knowing this, we can take action to remedy the situation – either fix the refund situation, or address the margin problem in another way.

Truth is…

There’s not a snowball’s chance in hell I would notice something like that with the reporting the way it used to be.

These are known as Management Accounts.

They’re a separate set of reports that take the base numbers recorded by your bookkeeper and present them in a different way – the way you need them presented in order to make sense of your own business.

When you think about it, it’s blindingly obvious that you need reports like this.

How could you operate with anything else?

It’s just that accountants don’t tend to produce reports in this way by default, because they have other things to worry about – namely reporting things according to legal obligations.

For example:

- Different VAT treatment according to jurisdiction

- Payroll

- Items that are expensable (legally)

As business owner, you don’t care about this stuff at an operational level, because they don’t inform strategy.

But they’re crucial for accountants to understand.

And so accountants will design their chart of accounts in such a way that makes their reporting obligations easy.

And fair enough – that’s what you’re paying them for!

(Not trying to dunk on accountants here!)

But for a new entrepreneur, who’s never done this s*** before, you’re hardly equipped to be able to sit down and say:

“Now, I’d like to redesign our chart of accounts from the ground up, please, in order to give me operational visibility by product line and department.”

Reality is, unless your accountants routinely do this as part of their services, I’ve found it simply easier to hire a separate firm to produce management accounts directly.

It circumvents the BS, and gives you what you need fastest.

And what do you need?

The ability to spot trends.

That’s the game-changer. At least it has been for me.

And this, in turn helps you step back even further…

Checking in only one a month…

Because not only are your key numbers all laid out for you…

You’ve also got a team who are looking at them each month.

Helps you sleep at night.

(If you have a 7/8-figure business and are looking for top-tier management accountants, hit me up, I’ll put you in touch with mine.)

Conclusion

So that’s who you need in your finance team:

- Front-End: Invoices & payments (Role: Finance assistant)

- Middle: Bookkeeping (Role: Bookkeepers)

- Back-End: Reporting & accounting (Role: Accountants & Management accountants)

Like I said, you might not need all of these.

For example, if you’re a high-value, low-volume business, you might not need separate management accounts.

Similarly, your accountants might be able to handle your bookkeeping.

You might be able to have someone on your team handle payments, and you approve manually yourself.

But mark my words…

When problems do start to arise…

When you start to feel confused, or doubts creep in…

When you start to feel an unidentifiable sense of anxiety around finances in your business…

I’ll bet you the biggest steak in Texas that you’re going to need to make a change in at least ONE of the functions we’ve covered today.

That’s it.

I’m going to be getting a lot of new clients for financial services people with this.

Perhaps I should do what all the big Twitter personalities do and buy a large stake in an edgy new finance services startup!

On the other hand…

I could just wander down to the beach and have a coffee by the sea.

Throw stones at seagulls.

I’ve found myself unexpectedly binge-reading a series of trashy romcom novels called “Virgin River” and I can’t put them down…

Which I hate myself for.

I mean – seriously?

Yeah.

I’m not all haute culture and high-mindedness.

I have a trashy side too.

At least I’m being up-front with you.

Namaste,

Olly

P.S.

If you want to go deeper on my whole philosophy for finance, I have a full workshop here.

CASE STUDY: Blueprint Of A $10m Online Education Business:

Join my free newsletter for online educators and I'll send you the case study immediately...

We will protect your data in accordance with our data policy!