In this post:

How to create a “financial operating system” for your business and personal money.

We want you to feel completely in control of finances, with zero anxiety in sight.

If you ever feel an underlying anxiety about money, this will help.

Now, without any futher ado…

Necessary disclaimer: Entertainment purposes only. Not financial advice.

Rich people with money problems

When I used to coach entrepreneurs, there was one topic that would come up, sure as night follows day.

“I’m anxious about finances!”

Sometimes business.

But more often, personal.

And this was with entrepreneurs making low to mid six-figures… hardly short of a bob or two!

The funny thing: Their stress was not because of a lack of money. Or even having too much money (all too common). Rather, their financial anxiety was down to something else all together…

Entrepreneurs don’t have good systems for managing money.

Today, I’m going to lay out what is the essential financial operating system for online business owners, that is designed to do one thing, and one thing only…

Give you peace of mind, so that you can run your business from a place of abundance, safety and generosity.

One baby and a wad of cash

Back in 2015, when I packed in my career as an English teacher, I moved back to London with a four month old baby, a small wad of cash in my back pocket, and a business that was barely operational.

The wad of cash would have to last me a while…

Because I didn’t know where the next money would come from.

It was a scary time.

But also a productive time.

There’s nothing like the threat of sleeping under a bridge to light a fire under you.

So I knuckled down, and worked on my business.

In hindsight, it sounds like one of those classic entrepreneurial stories you hear about on podcast…

“Yeah dude, I just had to make it work. I had no choice, man!”

But behind the scenes, I was concerned:

“I have to do whatever it takes to make some money, and hold onto that money, so that I don’t have to go crawling back to my old job.”

This is the scrappy, entrepreneurial mindset.

Perhaps you recognize it?

It’s where we all start.

But here’s the thing…

Years later, once you’ve grown a successful business, you’re most likely still operating with that exact same scrappy mindset, because…

Nobody ever told you to stop thinking that way!

Keep hustling.

Keep making money.

And for Heaven’s sake… keep hold of it once you’ve got it!

Here are some of the tell-tale signs, you’re still operating in the scrappy, start-up mentality:

- Bank balance management – you look at your bank balance every day and make emotional decisions based on how much money is in there

- Hoarding cash - you let $100,000s build up in your bank account, reinvest in dribs and drabs, letting inflation eat the rest away

- Anxiety - the more cash builds up, the more anxious you get, as you worry about what to do with it

- Personal withdrawals - you withdraw the money personally and start buying real estate because “it’s safe”, losing half of the money to tax along the way

- Lifestyle upgrades - you move to a bigger house, buy your dream car, put the kids in private school, and start to worry about what happens if the business makes less money

As usual, I’m speaking from painful experience here.

(Apart from the private school bit.)

Excuse me while a take a long, deep, calming breath.

Ahhhhh…

There we go.

Now, where were we?

For someone looking in on the outside, they would be a bit confused about the behaviors I listed above.

“Aren’t successful business owners more sophisticated than this?”

“Surely successful entrepreneurs have good money systems?”

But it turns out…

Entrepreneurs are great at making money.

But terrible at managing money.

Why?

Because they’re still thinking like the scrappy bootstrapper they were when they first got started!

And while you can get away with this kind of “bank balance management” for a while…

Sure enough, a growing seed of doubt starts to grow inside you…

- I’m worried I’m not reinvesting enough in my business (but I don’t know how)

- I’m losing so much to tax (but I still want the cash)

- I’ll be in trouble if the business has a bad month (but I really like my new car)

And then, like an addict trapped in a spiral…

“I need to get more grown up with my finances, but I just can’t change how I think!”

It’s like the first-time parents who try to hold onto their old life of parties, travel and weekends away…

Running themselves into the ground and growing frustrated about the freedom they’ve lost…

Until, eventually, they realize that real happiness is right under their nose at home. All they needed to do was fully embrace the next stage of life, and they’d find a new, deeper kind of joy.

(And the social life comes back, of course. You just have to be patient!)

But it’s hard.

I’m here to give you the “money message” I wish someone had given me many years earlier:

You have to change.

You must change.

Your life (and business) depends on it.

Where does your money work hardest?

So, in a minute, I’m going to describe what I believe to be an “optimal” foundation for your finances - business and personal.

But it’s important to start with a principle:

Your business is always going to be your biggest wealth generator.

Whenever cash sits in your bank, it’s getting eaten away by inflation.

Whenever you take money out personally, not only have you paid 20% corp tax on profits, but you’re paying a further 39.35% on dividends. (UK numbers, assuming higher rate bracket).

That’s an effective 51% tax… before you even talk about the personal allowances that you might lose.

It’s probably closer to 60%, all in.

And there’s nothing you can conceivably do with personal cash that can safely earn you more than 8-10% annually.

Whereas, by keeping and reinvesting money in your business, you not only save on personal and corporate tax, but have the ability to easily get a return of 20-50% on that same money.

So…

The aim of what I’m going to show you next is to:

Create a mindset of abundance and security that allows you to invest fully into growing your business, so that you can build far greater wealth over the long term.

Let’s dive in…

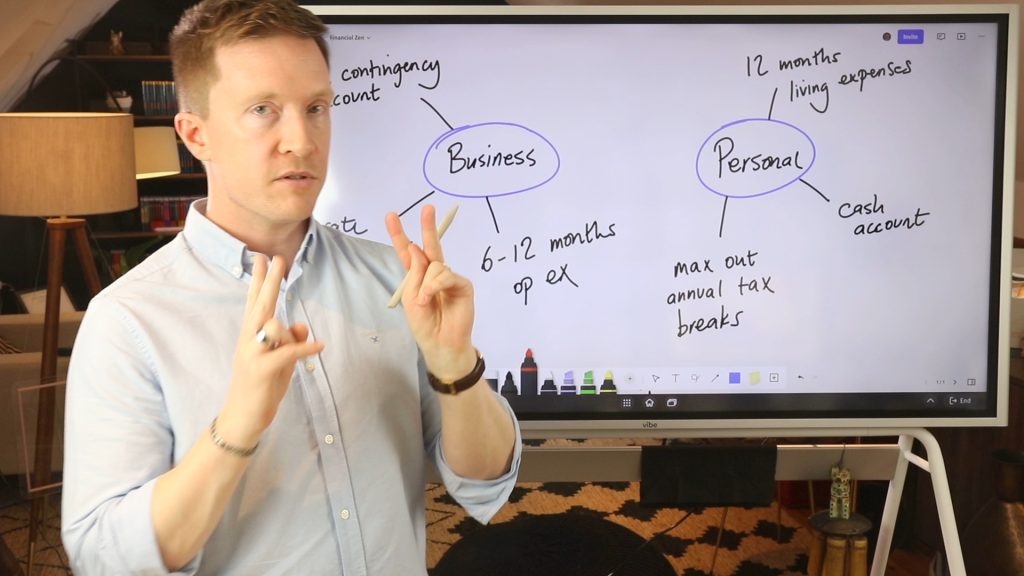

How to manage your finances

So here’s what I recommend you do.

First, stabilize the business:

Accumulate 6 months’ operational expenses in cash, and put in a separate bank account that you don’t see or touch.

(I actually put mine in a corporate unit trust, so that the money’s working harder. It’s slightly less liquid, but I figure it’s highly unlikely I ever need it, so makes sense.)

By operational expenses, I mean the amount of cash you’d need to keep the business running assuming that all revenue dried up tomorrow.

And yes, that includes your salary.

(You’d need to keep living, right?)

6 months is pretty conservative, and high-growth companies would keep more like 1-2 months. (Apparently, Microsoft keeps 12 months.)

But remember, we’re optimizing for the “here and now”, not future equity value.

The aim here is to remove all fear of worrying about money. Even in a doomsday scenario that tanks your business (e.g. Covid), you’d still have a full six months to figure things out…

And that’s assuming you make literally $0 in the interim… highly unlikely.

With all fear removed, you can then reinvest abundantly in the business, or any other opportunity that may arise.

We start with the business, because that’s your cash cow.

Second, stabilize your personal finances.

Accumulate 12 months’ personal living expenses in cash, and put in a separate bank account (ideally with high interest) that you don’t touch.

For the avoidance of doubt…

What are your gross monthly living expenses as a family?

Mortgage, car, food, travel, utility bills…

Add it all up – that’s your number.

You need 12X that.

If you’re starting from scratch, this won’t be a quick process…

First, you need 6 months’ business cash.

Then, 12 months’ personal cash, after accounting for all relevant taxes.

It might take you a year or more to build up.

So why bother to do any of this in the first place?

Finding financial Zen

“But wait, Olly! Having started this newsletter by saying it’s wrong to hoard cash, you’ve just told me to… hoard a bunch of cash! Are you high, or what?”

No, my friend, this is quite the opposite of hoarding.

This is “strategic accumulation”.

Let’s revisit our doomsday scenario:

- Your business has been slammed

- All revenue dries up

- You sit twiddling your thumbs as you burn through your 6 months of business reserve cash…

- And fail to buy yourself any extra time by cutting costs etc

Even if all that happened…

You’ve still then got 12 whole months to figure s— out before you run out of personal cash!

For you to be left penniless in this scenario would take a calamity of biblical proportions.

Can we agree that this is unlikely to happen?

We can?

Good.

So then, take a step back.

With this big, fat safety net in place, this places you firmly in a state of financial abundance.

You have removed any rational fear of running out of money… (The irrational fears will always remain)

And you can now proactively experiment, test, even play with cash to learn new things and grow your business…

Without fearing mistakes.

Here are some of the things you should put on the top of your list to spend on:

- Business - Reinvest in the business, by hiring, building, improving, or running a team retreat!

- Learning - Hire a coach or mentor to learn the things you don’t yet know. (Likely your #1 ROI of all.)

- Investing - Get involved in other businesses where you can add value.

And if you’re not used to investing back into your business, or into yourself, it’s a skill in itself that needs practice.

But by allowing money to flow to these things, this is how you will earn that 20-50% return that will grow your wealth faster than you can say Jack Robinson…

While leaving you free from the kind of money stress that can suck the joy out of life.

So there we have it.

If you enjoyed this, you’ll love edition 003 on Why Money Isn’t Real.

And if you’ve enjoyed this, please sign up to the newsletter (below), and you’ll get a new edition delivered straight to your inbox each week.

I’m cycling through a few topics in these newsletters - finance, mindset, strategy.

Let me know which you enjoy and would like more of.

Namaste,

Olly

CASE STUDY: Blueprint Of A $10m Online Education Business:

Join my free newsletter for online educators and I'll send you the case study immediately...

We will protect your data in accordance with our data policy!