Here’s my opening gambit for today’s newsletter:

Money isn’t real.

.

.

Still with me?

Then let’s proceed.

This is a wildly triggering topic, but if you’re the kind of entrepreneur I’m writing this newsletter for, then you will immediately understand what I’m talking about.

Ever had a wildly successful launch…

And felt completely empty afterwards?

Ever watched large cash reserves build up in your bank account…

And felt nothing but anxiety?

Join the club, my friend.

Money, you see, is not real.

I always thought it was…

There was a time when I thought money was the point.

But eventually, I realised money is something very different…

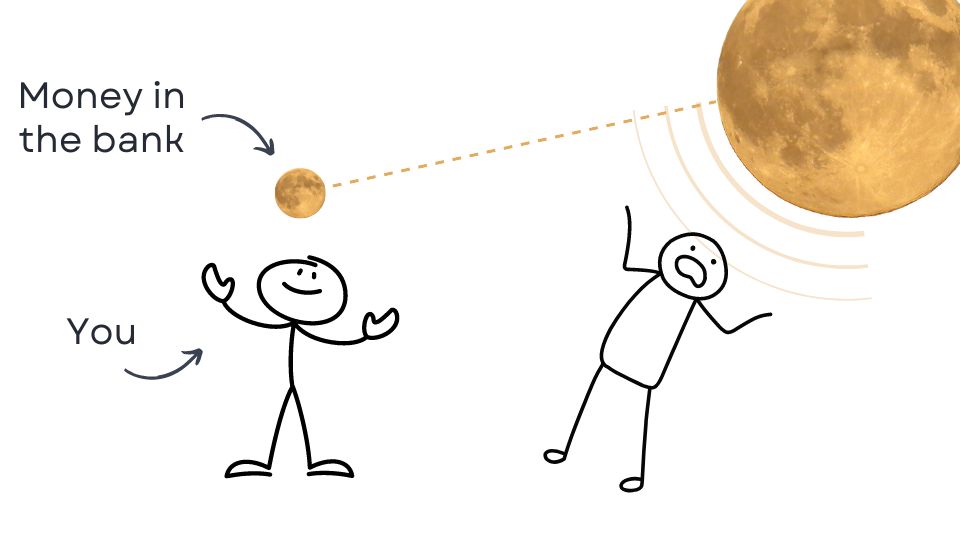

Money is a disruptive force with its own centre of gravity, that, like a new sun that suddenly appears in the solar system, will drag you out of your equilibrium and disrupt your sense of reality.

But all is not lost.

Learn what money is, and what it needs…

And you can create all kinds of new, weird and wonderful realities that make you a happier person and allow you to create real, positive change in the world, beyond anything you could ever imagine.

Enough hype for you?

Time to get into it…

Managing A Launch From Paradise

Here, in Hobbitshire, people take pride in living off the land.

Farms, kitchen gardens, fishing… even vineyards.

That’s right…

Thanks to global warming, we now even have the climate to make some pretty spectacular sparkling wines.

(English sparkling wine!? I know you think I’m crazy. But try a Bacchus from the Lyme Bay Winery and tell me it’s not outstanding. And if you’d like to send me a crate… that would also be acceptable.)

There’s also a thing here called “Country Chic”.

That is, super-posh interior design based on country themes.

Image Credit: The Newt in Somerset

The best place to find Country Chic is at some of the 5* country hotels that are dotted around the area.

One of my favourites is The Newt, which is, irritatingly, just outside the county boundaries of Hobbitshire.

Doesn’t stop me going though.

And, it was on one particular weekend last year, that I was staying at The Newt for a few days for a special event.

I love it there.

It’s a spa hotel, with cider orchards, outstanding food, open fire pits burning everywhere you go.

Proper country chic.

And I was loving it.

Anyway…

That exact same week, we were also running a huge launch over at StoryLearning.com.

We have our launches down to a tee now, and they’re fully managed by the team – I’m not involved in any way.

I do keep an eye on things, though, and on that particular week, as I was strolling nonchalantly through apple orchards, I was pleased to watch our biggest ever launch unfold.

Now, I’ll level with you…

It was one of those “Isn’t life great?” type of experiences…

Watching hundreds of thousands of dollars flow into our bank account over the space of one week, while sipping negronis next to an open fire.

But before you roll your eyes any further…

The veneer didn’t last long.

As the launch revenue stopped flowing, I left the hotel and went back to reality, I noticed my smugness start to shift gradually towards something more unpleasant…

“What’s the tax bill going to be?”

“How much is getting eaten away by inflation?”

Followed by some darker thoughts…

“What if this is the last time we ever do a successful promotion?”

“Shouldn’t I take money off the table, just in case?”

And, as unlikely as this sounds…

“What if the business all comes crashing down?”

Weird, right?

Except it’s not.

It’s totally f****** normal.

The Instinct To Conserve

You might think that it takes a real crisis to prompt thoughts of everything crashing down.

But the opposite is true –

It’s the very presence of money that’s most likely to give rise to these destructive thoughts.

Wind the clock back 10,000 years.

For hunter gatherers, there was no such thing as money to worry about.

They had a much more basic set of concerns – food and shelter.

But don’t go thinking that we have evolved all that much.

The hunter gatherer who returns one day with a gigantic stash of food, has only one instinct…

To conserve.

What happens if tomorrow’s hunt yields no food?

What happens if we get hit by famine or drought?

So they conserve the food as best they can, making it last as long as possible, rationing it carefully, perhaps storing it away.

The wellbeing of everyone who depends on them is on the line.

That is the nature of life.

Today, we are no different.

Except...

The entrepreneur, with their basic needs taken care of, conflates money with the hunt.

In the early stages of business, money is the lifeblood. We strive and toil all day to make it.

So, when we get it…

We have one basic instinct…

To conserve it.

This is why we…

- Hoard money (even though it is eaten by inflation)

- Invest it in “safe” assets – money markets, real estate (even though the returns barely keep pace with inflation)

- Pay off the mortgage (even though it’s the cheapest money you’ll ever borrow)

People will do far more to avoid losing money than they will to earn it.

It’s called loss aversion. (You’ve heard of it.)

But by striving to conserve money, you violate the principles that made you an entrepreneur in the first place:

The ability to create value at scale

And this is where problems begin…

Your actions betray your values.

A Tale Of Two Kings

There were two kings.

Both kings received a windfall of gold in each of their kingdoms. They were very rich.

The first king vowed never to lose his riches.

So he built a vault, surrounded it with guards, and let it rest, safe from harm.

The second king was different.

The second kind invested the money into his kingdom.

He built infrastructure - roads, schools, hospitals and farms. His people were paid for their labour.

In the early years, all his money flowed out into these projects. The king retained very little.

But after a few years had passed, the two kings were no longer equal in wealth.

One was far wealthier than the other.

You don’t need me to tell you which.

Money Needs To Flow

What I’ve talked about so far, is why our instinct to conserve leads to poor decisions around money.

And how that leads to disharmony, and worse…

Apathy.

Confusion.

Even depression.

And this happens because we raise money to a pedestal above what actually matters to us.

We just don’t know we’re doing it.

The entrepreneur regards money the same way the hunter gatherer regards food.

Lifeblood.

When you don’t have money, it’s all you strive for.

(“Got to get to a safe place!”)

Except…

When you finally get money, you realise that money was never the point.

You already had the food to eat. You didn’t need any more.

Not only does the “success” of having money not make an iota of difference in your happiness…

You realise that you can’t even hold on to it!

Conserving money is impossible.

Money is energy.

Money needs to flow.

And this is why money isn’t real.

All it can do is flow in… and flow out.

Your job as the entrepreneur is to steward money to the places where it can create most value for the world, via fair exchange.

Because it sure as hell isn’t going to create happiness for you.

Why Does Nobody Talk About Money?

The reason I’m devoting an entire newsletter to this, frankly, is because I need to write this for myself.

(Could you tell?)

Everything I’ve written, here is a note to myself. Part of my ongoing efforts to do the thing that I’m teaching here.

Much of this is a result of discussions with my friend Scott Oldford, who’s talked me down from the brink of bad decisions more than a few times.

Nobody talks about money, and nobody teaches the psychology of money.

Whenever I have conversations about money with entrepreneur friends, it always ends with the conclusion. “Damn, why does nobody talk about this stuff?”

So here I am talking about it.

To summarise:

- As your business grows, you will make more money.

- At some point on the journey, the presence of money will lead to struggles or anxiety.

- This happens because the Centre of Gravity of money pulls you out of alignment with your core values as you try to conserve it.

- You are liable to make poor decisions based on that anxiety.

- The solution is to have a well developed set of principles for how you use money, so that money keeps flowing.

- Develop these principles, you will make better decisions.

My Money Framework

I’ll tell you what my money framework is.

It won’t be the same for you, but it might be useful to hear this from someone else.

I try to keep this deliberately simple, so that whenever questions around money arise, there’s no dilemma. I know exactly what’s going to happen.

To start with, I build my businesses to keep. I may sell in the future, if the stars align, but I’m equally happy if I don’t, and I work on that basis.

As such, I’m not counting on a big future payday.

This means that I need to grow my personal wealth alongside the equity value of the business so that the personal side is not ignored.

(Many startup founders never take a sensible pay cheque themselves, hoping instead for the glorious exit.)

With that said, money is always going to be best deployed within the business, as it can grow much faster there, and is far more tax efficient.

So, the first priority of available cash is to fully resource my main business, StoryLearning.com. Whatever resources it needs within its current growth curve, it gets. (This is the single place I have most control and growth potential.)

The next priority is any lifestyle needs or wants I have.

I’m pretty low-key really, but if I want to act from a place of abundance, then I don’t want to deprive myself of anything I reasonably want to do - holidays, hobbies, donations, etc.

Once this is done, we get to surplus.

Remaining (surplus) cash gets divided 50–50 between two places:

- 50% to any business investments, acquisitions or projects I want to start

- 50% is mine to take off the table as dividends - I might pay down the mortgage, buy property, whatever makes sense to me at the time

I know that I have two sides of my psyche…

One is the entrepreneurial desire to grow, take risks, and fulfil potential.

The other is the more conservative, scarcity, minded person who craves safety.

I don’t claim to understand these two personas exactly…

But I know they exist.

I feel like this is a sensible balance that allows both to be satisfied.

Use The Energetics Of Money To Find Peaceful Profits

In summary…

Entrepreneurs can be conditioned to conserve money, having worked so hard to get it.

However, hoarding money creates an unnatural “Centre of Gravity” that can drag you out of alignment with your core values of why you became an entrepreneur in the first place.

Instead, money needs to flow.

When money flows, value is created. And creating value is your primary entrepreneurial “Why”. This creates harmony, alignment, and energy in your life and business.

For money to flow responsibly, you need a decision framework. This framework makes it easy to know what to do, when money comes your way.

Damn…

Writing this has been its own form of therapy.

I do hope you found it useful.

Let me know: @mrollyrichards

Namaste,

Olly

CASE STUDY: The blueprint of a $10m online education business:

Join my free newsletter and I'll send you the case study immediately...

We will protect your data in accordance with our data policy!