From: Olly Richards

Hobbitshire: Literally sitting in a castle right now

Entrepreneurs are weird when it comes to money.

We great at making it.

But once we have it…

We’re terrible at knowing what to do with it!

One of the reasons this happens:

Nobody talks about managing money!

So you’re kinda left to figure it the whole thing out for yourself, getting your inspiration from tidbits on podcasts, random conversations at meetups, or that thing your mum told you when you were 17.

In this newsletter, I want to talk fairly openly about all this finance stuff, because it would’ve helped me adjust from broke jazz musician to stewarding a multi-million dollar business.

So today, I’m gonna share one of the big conclusions I’ve come to:

Money needs a plan.

And if you make a half-decent plan, it might stop you from blowing all that money you’ve been working so hard to make.

Why You Do Stupid S***

Here’s the main reason you need a plan for handling money:

Without a plan, you’re liable to do stupid s***.

- buying expensive stuff you don’t need (self-therapy)

- overpaying for staff (“they’re really nice”)

- hoarding huge amounts of cash (because you like how it looks in your bank account)

- starting to invest in other companies (before you have your own house in order)

Why does this happen?

Entrepreneurs are not used to the emotions around having and handling money. (See here)

Making smart money decisions isn’t easy.

And that’s a problem.

Because if you don’t learn to handle money properly, you’re likely to make emotional decisions instead, often properly regretting them later.

So what’s the fix?

Well, learning to direct money properly isn’t a question of some genius Warretn Buffett-level investing insight…

It’s to have more conversations...

It’s to learn more....

It’s simply to think through what you want in life, and have some semblance of a plan of how you’ll use money to get it....

It’s sticking to the plan, once you have it.

Not because I want you to have some boring life, but because:

You learn lessons from sticking to plans, not by making u-turns every time the wind changes direction.

Just ask Buffett.

The Conflict of Personal vs Business Cash

As an entrepreneur, you have very real money dilemmas.

The core dilemma is the dynamic between:

- business cash

- personal cash

On the one hand, money will always get a higher return reinvested into your business.

On the other hand, if you never take anything out, you’re not building any personal wealth.

But there's no decision without consequences.

Here are some of the dilemmas you face each time you make a money decision:

- Whenever you take money personally, you lose 50-60% to tax (corp tax + div tax)

- On personal money, the maximum you’ll safely earn is 6-8%. (Isn’t it better to save the tax and keep the money working inside the business?)

- You want to pay down your mortgage, but it’s the cheapest money you’ll ever have (So why pay it off?)

- You have good annual allowances and tax breaks… but they’ll take 20 years to add up to anything significant

However…

- You have 80-90% of your net worth tied up in the business (and that doesn’t seem smart)

- The cash you hold in the business is losing 10% to inflation just sitting there

- You want to grow your business, but you know nothing lasts forever. (When will my luck run out?)

- And do you even want to keep scaling, with all the headaches that come along with it?

- What’s the point of running a successful business if you can’t enjoy the fruits of your labour?

These are very real tensions.

And can be emotionally draining.

The answers will be different depending what you want from your business.

Personally, I want a business that allows me to spend the morning on the beach, fly my plane, and take my daughter for singing lessons after school.

And given that I’m lucky enough to have that right now, I’m less interested in “Gotta 10X, bro!” and more interested in intentionally rebalancing my net worth away from the business and into personal holdings, until the point where I could just walk away if I wanted.

But this requires a plan.

Without a plan, you’re bound to make some expensive mistakes:

NFTs, anyone?

Point is…

The real problem here is not that you need to become Buffett.

The real problem is not having any plan at all!

And so, you should spend time intentionally developing your own philosophy to money.

Because the reality is:

Either you figure out a plan for handling money yourself…

Or you spend your whole career thrashing about in a bloody mess of tax bills, doomed NFTs and equity stakes in failing companies that sounded so good at the time…

Your Personal Money Thesis

So far, I’ve made the point that you should work to develop a personal thesis around using money, to avoid making expensive mistakes that undo all the profit you worked so hard to make in the first place.

The odds are that you’ll never sell your business (fewer than 0.1% of businesses ever sell), so you need to take your personal finances as seriously as your business ones.

So, you make a plan…

But remember…

No battle plan survives first contact with the enemy.

That is to say…

You’ll put together the perfect plan, only to find you’re not comfortable with in practice.

Something just doesn’t sit right.

- You read somewhere that paying off your mortgage is stupid…

…but you hate debt and can’t rest easy until the mortgage is paid off. (Whatever the tax bill.) - You think it makes sense to reinvest 100% of company profits each year, to eliminate tax…

…but you can’t live with not taking any money off the table personally - You know you should fully-fund your pension each year…

…but your business has so much opportunity to grow that you want to give it every penny you’ve got.

A plan that sounds good in theory, doesn’t suit you in practice, so:

You’ve got to find the plan that makes you feel good in your own skin…even if it flies in the face of financial or entrepreneurial “common sense”.

This means you’ve got to cycle through a series of plans until you find the one that works for you.

The solution therefore:

- Create a simple written plan for where every future dollar of profit will go

- Don’t worry if it’s right or wrong, just write it down

- Stick to it for 6 months, try it on for size, see how it feels

Don’t feel comfortable with it after 6 months?

Great!

You’ve learnt something.

Tweak the plan and try again.

The goal is to eventually arrive at the right balance through embodied experience…

Not theory.

Because the plan that you can’t fully embody is like a ticking time bomb… you’ll eventually blow it up because you’re not comfortable with it.

Where Will Your Money Go?

Here are some guiding questions to help you think through where your money should go:

- What do I value most from my business? (e.g. free time vs big bucks)

- Is my current money management in alignment with this value?

- Is my business in growth mode? Am I giving it the cash it needs to fulfil its potential?

- What % margin am I comfortable operating the business at?

- What personal allowances are available to me? Am I using them? (e.g. pension, tax-free savings accounts)

- What cash balance makes me feel safe?

- What could I spend more liberally on that would help me enjoy life in the way I like to?

- What is “my number”? When will I hit that number at current rates, and is that acceptable to me?

- Do I have 3-6 months emergency fund in place?

Now...

I thought it would help you to give my answers to some of the questions above.

This is absolutely NOT to say that this is right or wrong. I find that hearing other entrepreneurs’ approaches to managing money is very enlightening for me, so I thought…

Why not divulge everything to 3,500 people?

(What could possibly go wrong?)

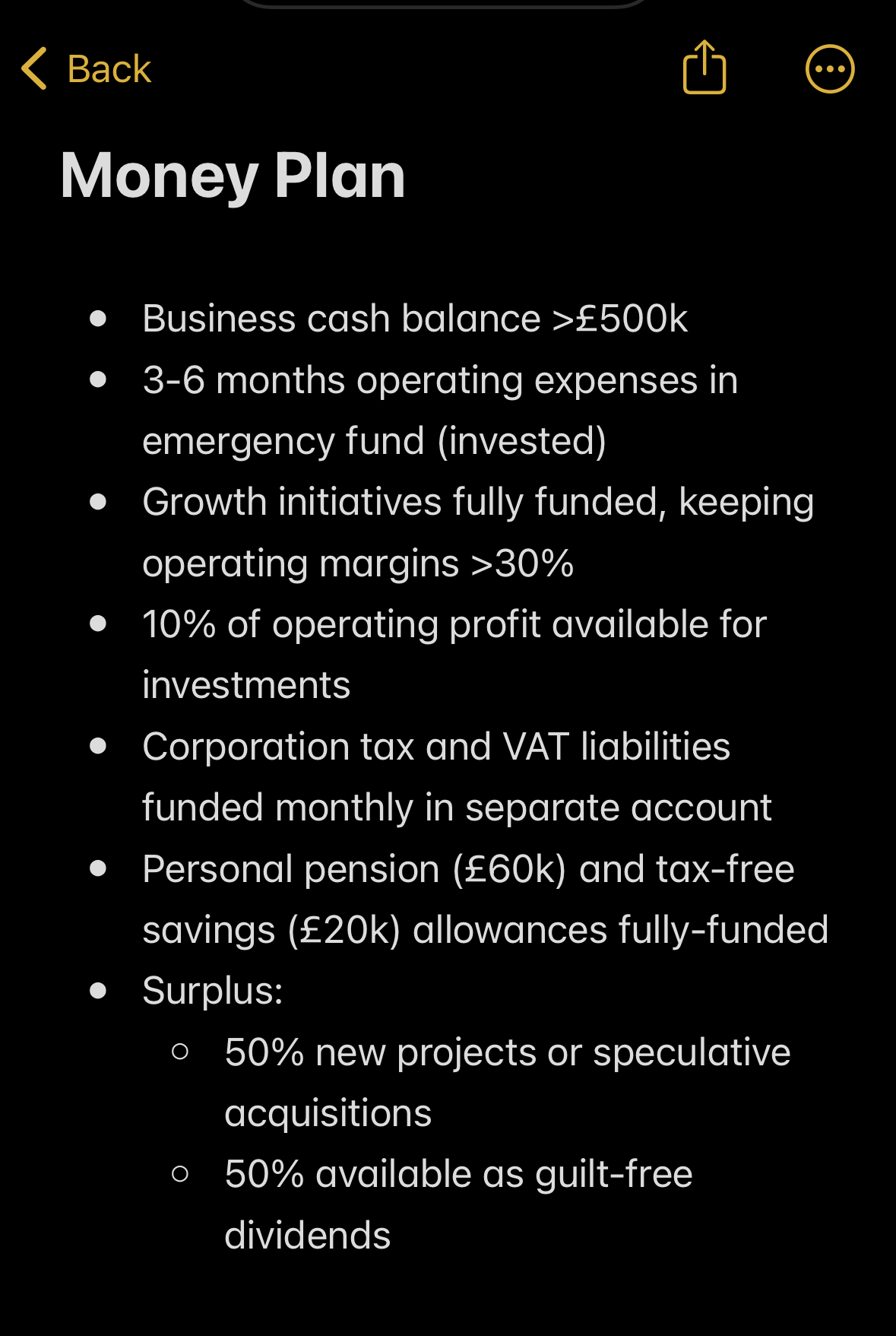

So, here's a look at how I direct money within my business currently...

Whatever.

Above is the bullet point breakdown. Here’s the explainer…

- My priority in life is maximizing discretionary time, family time, travel, etc. I know this for a fact. I’ve tried the “hustle, grow, crush” thing… it’s not for me.

- Fortunately, my business StoryLearning already affords me time freedom, so my financial strategy is:

- invest into the overall health of the business as appropriate

- grow within our means (don’t overspend on growth)

- new initiatives cannot involve my time

- What constitutes growing within our means? Well, StoryLearning is currently in growth mode, and so to support that, I’m willing to allow net margins to fall to 30%, with all surplus going directly back into growth

- I like to keep minimum £500,000 cash (or equivalent) balance in the business. This is far more than is needed, but I’ve found through experience that this number allows for:

- peace of mind

- ability to be opportunistic

- Every month we estimate our liability for corporation and sales taxes, and set the cash aside in a separate account

- The UK has pretty generous annual pension (£60k tax deductible) and tax-free savings allowances (£20k). I choose to fund these to the max, because there aren’t that many ways to get money out of a company, and doing this regularly creates a compounding powerhouse over time.

- Maximum 10% of annual operating profit can go towards strategic investments - e.g. buying stakes in companies that are complementary to StoryLearning. (Note: I wouldn’t recommend getting involved in investing unless you’re seeing at least $1M of operating profit - there’s a steep learning curve and it can be a big distraction. See Chapter 9 of the Case Study on diversification for more on this.)

- With all this said and done, I consider any extra cash to be discretionary. From this:

- 50% can go towards any more speculative acquisitions or projects I want to start

- 50% is mine to take off the table as dividends - I might pay down the mortgage, buy property, whatever makes sense to me at the time

What’s “My Number”?

Well, that’s private. But, in truth, it will take a long time to reach using the above method.

However, I don’t care, because I’ve managed to engineer the time freedom I’m looking for within the existing business.

And so, instead of trying to push StoryLearning beyond its natural limits, I choose instead to invest my knowledge in building new projects that have even more long-term potential. (As explained here.)

The ultimate goal is to build a network of business assets so strong that:

You could drop an atomic bomb on all my assets, and leave enough surviving that my personal life wouldn’t take much of a hit.

That’s my plan.

It’s how I like to do things.

It’s certainly not for everyone.

But hopefully, the opportunity to follow along with the thought process will help you consider your own plans with a bit more clarity.

And if you want to learn my complete framework for thinking about and managing money inside growing businesses, you might like my Financial Zen workshop.

CASE STUDY: Blueprint Of A $10m Online Education Business:

Join my free newsletter for online educators and I'll send you the case study immediately...

We will protect your data in accordance with our data policy!